Investors and consumers have been paying close attention to the Federal Reserve recently, wondering when they will begin raising interest rates. While the Fed meets this week, I want to walk through what you as a consumer and investor can expect when interest rates do rise. But first, why raise interest rates?

Why Raise Interest Rates?

In today’s economy, the Federal Reserve would raise interest rates to slow down inflation. While inflation that is measured by the Consumer Price Index is tame, as consumers, we see rapidly rising prices, especially in the grocery store. By raising interest rates, you lower demand and increase the costs to borrow. Here is how rising interest rates impact you first as a consumer.

What to Expect as a Consumer

When interest rates rise, as a consumer it costs more to borrow money. The interest rates on your mortgage, auto loan or credit card will rise. This will mean more money going towards debt repayment (because of a higher monthly bill) and will force consumers to cut back on spending in other areas.

What to Expect as an Investor

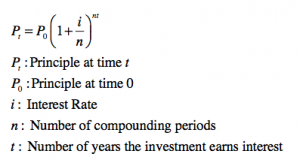

When it comes to rising interest rates as an investor, there are many more things in play. First, rising interest rates will mean an increase in the interest you earn on certificates of deposits and bank accounts. However, the increase in the interest rates does not happen overnight. It takes time for the banks to raise the rates they are paying you. Therefore, when interest rates do increase, don’t expect to see better interest rates on certificates of deposit any time soon.

Rising interest rates also will have an impact on bonds. Bond prices have an inverse relationship with interest rates. This means that as interest rates rise, bond prices fall. As a bondholder, you can expect to lose some principal when prices drop, but you will see a larger monthly payment from your bond fund when interest rates rise.

Note, however, that some bonds are impacted more by rising rates than others. Short-term bonds don’t lose as much money when rates rise because the duration is short. Long-term bonds though are very susceptible to rising interest rates.

Don’t Forget About Businesses Too

Rising interest rates could cause prices at the grocery store and other places to rise as well. Remember that rising rates affect everyone, including businesses. It will cost more for businesses to borrow money and run their operations. They need to make up the money somehow. This could be in the form of higher prices, or even laying off workers or suspending hiring new employees.

Final Thoughts

There are many consequences to raising interest rates. Given the current economic climate we are in, raising interest rates now could do more harm than good. While the stock market has done well since the recession, other areas of the economy have not. The Federal Reserve has a lot to consider before raising interest rates. The real question for consumers though is when rates will rise.

When do you think the Fed will raise interest rates?

More on Your Money

- The Triple Benefit of Municipal Bonds

- 6 Successful Ways to Save Money This Year

- Is Inflation Impacting Your Spending Habits?

- How to Put More Money in Your Savings Account

- 5 Keys to Becoming a Millionaire