Have you heard of the new debt instrument the Treasury Department issued earlier this year? It is called the two year floating rate note. You may be wondering why the Treasury is issuing a new instrument now. The answer lies in the fact that it is still pumping money into the economy to right the ship that went off course in 2008. But what is a floating rate note and should you look into it as an option to invest your money? Here are all of the details surrounding the floating rate note.

Floating Rate Note: The Specifics

The new floating rate note (FRN) is a two year debt instrument that you can buy directly from the Treasury. Its interest rate “floats” because it changes every week when the Treasury sets the interest rates on 13 week treasury bills. This happens for two years at which point, the note matures and you get your principal back, with interest.

To purchase a floating rate note, you simply visit the Treasury website, TreasuryDirect.com. There you can buy the note in $100 increments.

Advantages of The Floating Rate Note

Of course with any investment, you have to look at both the advantages and disadvantages to know whether or not it makes sense for you to invest in the investment in question. So, let’s first look at the advantages.

Little/No Credit Risk: Since the floating rate note is backed by the U.S. government, there is virtually no credit risk. This is because the government won’t default on its debt. Of course, there is that small chance it could, but odds are, it won’t happen.

No Interest Rate Risk: Since the interest rate resets every week, there is no interest rate risk to worry about. For those of you unfamiliar with interest rate risk, it is the risk of being stuck with a low interest rate when interest rates rise.

For example, if you buy a 30 year bond that has an interest rate of 2%, there is considerable interest rate risk tied to this investment. This is because over the next 30 years, the odds are fairly great that interest rates will rise. You will be stuck holding a bond that only yields 2% while other investors are investing in bonds that are yielding more.

Added to this, you won’t be able to easily sell this bond either. After all, who is going to pay for a bond that yields 2% when they can get a bond that is yielding much more for the same price?

Short Time Frame: The note matures in two years meaning you don’t have to lock up your money for a long time. This gives investors a nice alternative to bank certificates of deposit.

Disadvantages of The Floating Rate Note

Low Interest Rate: If you’ve read any of my previous posts about investing, you know that risk and reward are related. If an investment carries a high risk, then the interest rate will be high. Think about corporations that are in jeopardy of going bankrupt and issue bonds. The interest rates can easily be 7-10% because there is a good chance the company is going to go bankrupt and you are going to lose a lot of your investment.

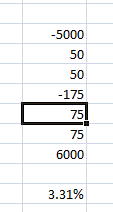

The same idea holds true on the flip side. If there is virtually no credit risk and no interest rate risk, how high can the interest rate really be? If you answered not high at all, you are correct. Currently, the Floating Rate Note has an interest rate of 0.09%. You can earn more at an online bank with a savings account! (Interesting fact: even with this super low interest rate, when the Treasury held the auction for these new notes, the demand was far greater than the supply. In other words, some investors don’t just look at the interest rate, but other factors as well. I’ll talk about this in greater detail below.)

The Unknown: I talk about this more below, but the assumption is that inflation and in effect, interest rates, will rise. The problem is, no one knows when this will be and as a result, you cannot “time” when you should buy the floating rate note.

Why Invest In The Floating Rate Note?

The question then becomes, why would you invest in the floating rate note at all? The answer for this question is inflation. Currently, inflation is fairly tame. But chances are it won’t be tame forever. As the economy starts to grow, so too will inflation. When inflation rises, so too will interest rates. This means that eventually the weekly resets on the floating rate note interest payments will increase, which will cause the yield to rise as well.

When will this happen? I have no idea and others have no idea either. Because of this, you can’t predict when the best time to buy will be. Sound familiar? It all comes down to what your investment goals are. For some, investing in the floating rate note now might make sense. They might favor the safety over the low interest rate. For others, it might make sense to hold out for a year or so until the economy starts to grow faster and inflation becomes a greater concern. For these people, they might need the income to live off of and as a result, cannot afford to invest in the note at current interest rates. At the end of the day, you have to refer back to you investment plan and make investing decisions based on that. Only then will you know when it makes sense, if at all, to invest in the floating rate note.

Final Thoughts

Overall, the new floating rate note is a great idea by the government. It gives investors another short-term investment product that carries virtually no risk. Of course, the cost for these great features is a super low interest rate. But as time passes, I’m sure the interest rate will rise, making this new investment choice more intriguing to investors.