To Roth 401k or Not to Roth 401k?

Roth 401ks have been around for a few years now, but have been recently increasing in popularity. In fact, my employer has just opened up an opportunity for its employees to invest in a Roth 401k in addition to the traditional 401k. I had heard rumors about these plans for a few years but have not paid much attention to them until now. And it got me thinking about the Roth 401k vs 401k: which one is better?

What is a Roth 401k?

For those of you haven’t heard of a Roth 401k, Madison has done a great job summarizing what they are and how they work.

Here are the Contribution Limits.

What does this mean to you?

Here are a few things to keep in mind when considering whether or not to invest in a Roth 401k:

- What do you think your marginal tax rate will be in retirement?

How much in the way of taxes you think you will be required to pay on the marginal dollar when you are retired. If the marginal tax rate at retirement is the same as it is now, traditional and Roth 401k’s are equivalent. However if you think your marginal tax rate will be higher in retirement than you are paying now, you might be better off with a Roth 401k.

But there are some considerations you should keep in mind. What you think your tax rate will be at retirement applies only to the marginal dollar, which is the last dollar you can invest between traditional and Roth 401k. It is not the case with the entire contribution (or average dollar, rather than marginal dollar).

Marginal taxation means that income is taxed at increasing rates as it goes higher. Even if you think the marginal tax rate in the future will be higher, there will still be lower brackets and these lower brackets should be filled with money from a traditional 401k first. If it is filled with money from a Roth 401k, you will actually end up being worse off.

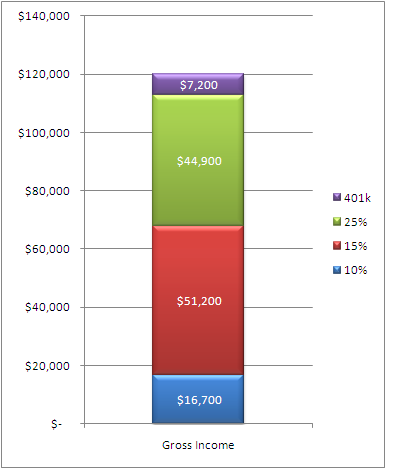

Confused? Take the below example (A married couple earning $120,000 between the two of them if they file jointly using standard deductions, and 6% total 401k withholding):

Because the way the traditional 401k works, the dollars this couple contribute are “taken off the top”, in their income’s highest tax bracket. After they retire, the dollars they withdraw from their traditional 401k fill in from the bottom tax bracket first.

Even if their marginal tax bracket in retirement is higher due to tax increases, a large portion of the traditional 401k withdrawal may still be taxed at a lower rate than what it was when they contributed the money during their working years.

Until you know you can generate enough income from your traditional 401k to fill the lower brackets, it doesn’t necessarily make sense to contribute to a Roth 401k. However, if you expect to have a large balance in a traditional 401k (or IRA) or a defined benefit pension plan, either of which (or combined) are large enough to fill your lower tax brackets in retirement, then contributing to Roth makes some sense.

- Is your current income higher than the Roth IRA limit?

The Roth 401k offers an advantage to high-income earners who are unable to contribute to a Roth IRA because of income restrictions. There is no such restriction for a Roth 401k. By getting around this income restriction and utilizing the ability to roll over a Roth 401k to a traditional Roth IRA, you could potentially utilize the Roth IRA’s inheritance advantages. Know that you can do a similar exercise to a traditional 401k as well (first by converting to an IRA then to a Roth IRA), although you will incur a tax liability when you roll that over into a Roth.

- Where do you plan on living in retirement?

Does the state you work in have a high income tax? Do you plan on living in the same state in retirement or do you plan on living elsewhere? What happens if you move from a start with high taxation during your working years to a state with a low level of taxation? Chances are, you’ll have no idea where you’ll end up living in retirement.

However, if you end up moving to a low-tax state like Texas for your retirement, contributing to a Roth IRA would make no sense. By prepaying your tax liability by contributing to a Roth 401k, you would be forgoing a beneficial tax-free contribution in a high tax state, and you would not see the benefit if you happened to live in a low-tax state. You would end up paying more taxes over your life than if you had gone with a traditional 401k.

- Do you take advantage of income-based tax write-offs and/or credits?

By contributing to a traditional 401k, you are effectively telling the IRS that you make “less” than you otherwise would have. You appear less rich in the eyes of the government. On top of that, if you take advantage of tax incentives that are based on your level of income (such as the child tax credit, Roth IRA personal income limits personal exemptions, tuition credit, etc), you may find yourself making too much to be eligible in the future, even if your total salary hasn’t changed.

If that happens, you may not only end up paying more tax up front (in the form of a Roth 401k prepayment), but you may also pay more taxes as a result of programs you are no longer eligible for. Your “increase” in taxable income may even trigger the AMT. Contributing to a traditional 401k will help you qualify for tax benefits and escape or reduce the impact of AMT.

Is a Roth 401k for you?

A Roth 401k is good for people in low paying jobs now but expect to have high paying jobs later, such as current college students or recent grads. Or for the tiny minority of people who are already at the highest marginal tax level and expect to be there indefinitely. But the marginal tax rate concern, and your unique lifetime earned income (and ability to save) could mean you don’t see much in the way of a tax benefit in retirement.

Ultimately, your unique financial situation should be looked at by a tax professional in order to determine which route you should go. And remember, this is your retirement. Only you can make the best decision for your retirement.