Should You Reinvest Dividends?

Every quarter some of my stocks pay dividends. Depending on the various mutual funds I own, I receive a dividend from them either quarterly, semi-annually, or annually. I have all of these dividends set to reinvest back into the funds they came from. Why? Because by reinvesting the dividends, I increase the return of those investments.

The Power of Dividends

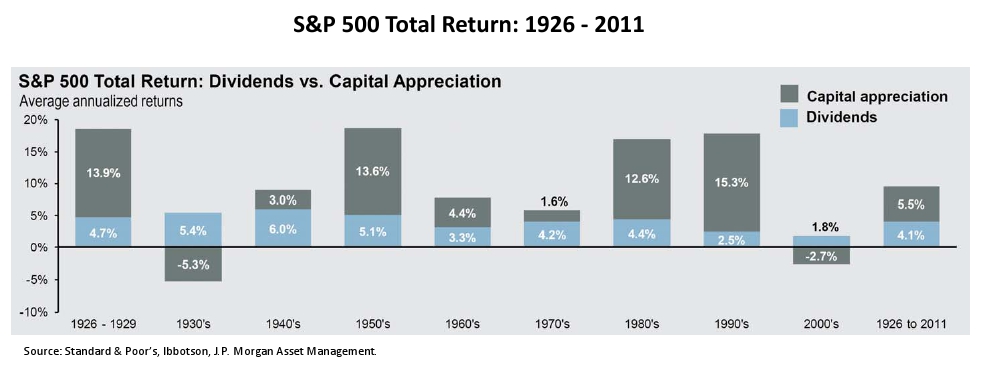

The chart below explains how this works. If you look at the far right side, you will see the return of the S&P 500 index from 1926-2009. If you add up the blue and gray boxes, you will see that it returned 9.6% annually over that time period. Looking closer you will see that of the 9.6% return, 5.5% is made up of capital appreciation, or increase in the value of the index. The other 4.1% comes from dividends. Over the past 85 years, over 40% of the total return of the S&P 500 Index has come from just dividends!

Looking at the decades presented, you can see varying capital appreciation return and dividend returns. While dividend return makes up less of the overall return in decades where the stock market performed well, such as in the 1950’s, in the 1930’s and 2000’s dividend return helped investors swing losses into break-even situations or even positive returns.

Proof of the Benefit of Reinvesting Dividends

Still think that reinvesting dividends is overrated? Let us say you and a friend each invested $100,000 back in 1926. You did not reinvest dividends while your friend did. What are your investments worth now (using the returns in the chart above)? Your $100,000 grew into $9,472,379 while your friends $100,000 grew to $242,045,550. You read that right, a $230 million dollar difference! I know what you are thinking, so here is another example, a more current one.

We will take $100,000 again with you not reinvesting while your friend does. What does your $100,000 invested in 2000 look like today? You have $72,004 and you friend has $89,719. While you both lost money, your friend lost much less. The reason is because his reinvested dividends increased his returns. Or put another way, offset his losses.

Is Reinvesting Dividends Right for Everyone?

If you are young and are investing for the long-term, you should most certainly be reinvesting the dividends that you receive. Hopefully, the examples above make that clear. But for those readers that are in retirement, reinvesting dividends may not make much sense. For my grandparent’s generation, dividends and bond interest have been a core element to supplementing their retirement income. They built a portfolio of stable, blue-chip companies that pay a nice dividend, along with high quality bonds that pay interest. Throughout their retirement years, they received their dividend and bond interest checks and used it as income, never touching the underlying principal (stock and bonds).

If you are investing for the long term, make it a point to reinvest all of the dividends that you receive. Doing so allows you to purchase more shares and increase your returns as years go by. If you are in retirement, take advantage of dividends and bond interest to supplement your income.

If you are retirement age, not reinvesting may be easier to report on income tax.