More and more I hear about the benefits to investing in dividend paying stocks. The idea is to invest in solid companies that pay a decent dividend. The more shares of the company you own, the more dividend income you will earn. For some, the goal is to have dividend income replace their work income so they can retire. For others, the goal is to use the dividend income now as a source of income while in retirement.

While this dividend investing strategy has its merits, there are some things you need to be aware of when going this route.

Why Are People Flocking to Dividend Investing Strategies?

The first question we need to ask is why the push to dividend investing? The answer is twofold. First, you have current retirees who use the income from stocks and bonds to live off of. Back when I was younger and my grandparents were alive, they mainly invested their money in bonds and the 5-6% yields on those bonds generated enough money to fund their retirement. For example, if you have $500,000 invested in bonds that pay 6% a year, you are looking at $30,000 a year in income. Add Social Security to this number and you can live a decent retirement.

But today, things are different. Bonds are yielding much less. In many cases, you are looking at best 2% for a yield. With $500,000 invested, that generates $10,000 in income per year. Even with Social Security, you are looking at a tougher retirement.

To overcome the low bond yields, many retirees have turned to dividend paying stocks. Here, they can invest in stocks that earn 3-4% in dividends, which comes out to $15,000 – $20,000 in income per year.

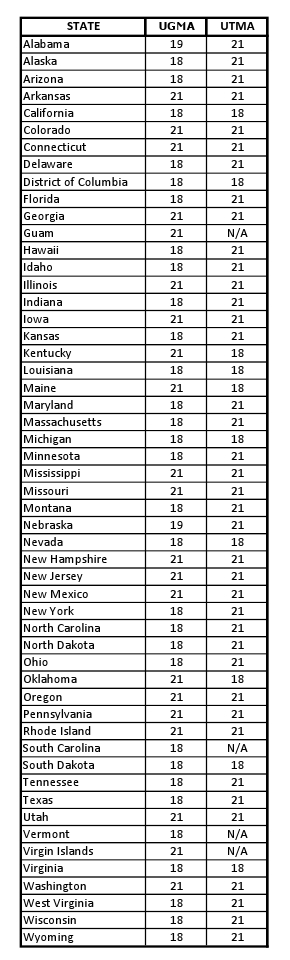

The second reason for the push to dividend stocks is that many investors are seeing the power of dividends. They realize that dividends are taxed at a lower tax rate if they are qualified and that these dividends can help to offset earned income. In other words, if you invest enough money in dividend paying stocks, you can eventually quit your job and live off of the income. When you get to this point, it is called financial independence.

The Potential Downfall of This Strategy

The major potential pitfall to the dividend investing strategy is that so many people are flocking to dividend paying stocks. As more and more people invest in these stocks, they push the prices higher and higher. What happens when interest rates start to rise?

Many of the retirees that are investing in dividend stocks solely for the higher yield will run to a lower risk investment, namely bonds. When they start leaving the market, stock prices will fall. We have seen evidence of this a few times when the Fed has signaled that it might soon raise rates. The stock market drops a couple hundred points.

Now, I cannot say how much the stock market will fall and I am not trying to incite fear in anyone reading this. As long as you have a long-term view of the stock market, you should be fine as prices will eventually come back. But, there will be the fear to sell and sit on the sidelines when stock prices fall. When you do this, the income you earned from the stocks will be offset by the money you lost in a lower share price.

What is a Good Strategy?

The best strategy is the same one that has been a good strategy in the past – hold a well diversified portfolio. If you have a nice mix of stocks and bonds and you have a long-term view of investing, you can weather any drop in the market and come out ahead in the future. The key though is staying invested.

Additionally, you want to make sure that your investments are set to have any dividends you earn reinvest to buy more shares. Why is this important? Over the past 90 years, dividends account for close to 40% of the total return of the stock market. What does that mean?

In a basic sense, if you did not reinvest the dividends you earned, you would have 40% less than you would have if you reinvested. That is a huge number.

Final Thoughts

The point is not to scare you out of investing. It was to talk about the potential pitfall of a popular investing strategy I see many investors taking a liking to. Always remember to look at both sides of the issue so that you know the risks as well as the rewards from anything you do.

If you are okay with the risks, then a dividend investment strategy could work wonders for you. But if the risks aren’t worth it to you, you might be better off sticking with a well-diversified portfolio.

More on Investing

- 11 Reasons Why Investors Fail

- What is a Dividend Reinvestment Plan?

- Finding Alternatives to Low Interest Rates

- 3 Steps to Successful Investing

- Earning Interest and Dividends on Someone Else’s Dime

- Investment Tax: What it Means For You

- Best Online Discount Broker Comparison