529 Plans versus UTMA Accounts

When I was growing up, my parents used an UTMA account to save money for my college expenses. Back then, it was really the only way to save for a child’s education. Nowadays, the 529 is a popular option. You may have heard about both types of accounts, but don’t know what the differences are between the two. Below I break down each account along with the benefits and drawbacks so that you can get a better idea of which account is right for your situation.

UTMA Account

An UTMA account, or Uniform Transfer to Minors Act account is a way for children to have ownership of assets. This is because minors are not legally allowed to own money or property, in a general sense. Because of this, each state has developed this type of account which allows for the child to have ownership of the assets. (A quick side note, UTMA and UGMA accounts are virtually the same except for the age at when the child has full ownership of the account. I’ll explain this in more detail below.)

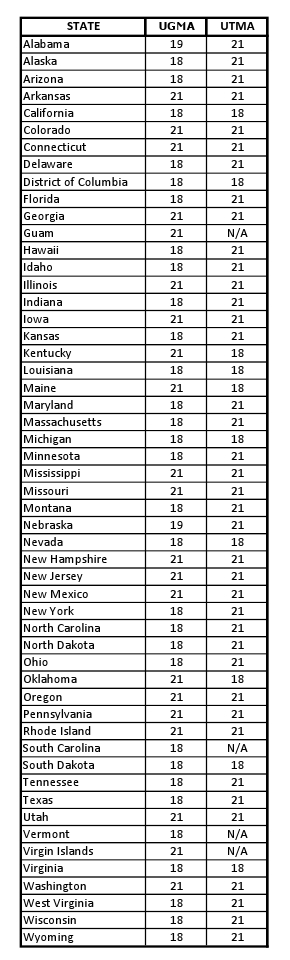

What age does the child take full ownership? An UTMA or UGMA account is a custodial account. The account is the child’s, but the custodian, usually the parent, has a fiduciary responsibility to manage the account for the benefit of the child. The custodian acts on the account (making deposits and withdrawals) until the child reaches the age of majority for your given state. See the chart below for the most up to date list of majority age by state.

Here is where the difference in UGMA and UTMA accounts lies. For UGMA accounts, the child gains full access to the account when they turn 18 or 21, depending on the state they live in. UTMA accounts can be in the parents control until the child reaches 25 years old, depending on the state.

Income Tax Considerations

Any interest on the account is taxed to the child since the account has their Social Security number was used to open the account.

Benefits of UTMA Accounts

A nice advantage to an UTMA account is the reduced taxes. For 2016, the first $1,050 of unearned income (interest, dividends) is not taxed. The next $1,050 is taxed at the child’s tax rate. Anything above $2,100 in unearned income is taxed at the parent’s tax rate, when the kiddie tax kicks in. Of course, once you hit the $2,100 threshold, the benefit of an UTMA account in terms of tax savings goes away.

Drawbacks of UTMA Accounts

The main drawback of an UTMA account is that it counts against the child if the child is applying for financial aid for college. This is because the assets are in the child’s name and colleges look at the applicant’s (student’s) assets when determining financial need.

Another big drawback is the money in the account is the child’s when they reach majority age. While this may not seem like a big deal, the fact is once it is their money, they can do anything they want with it. So, if the account has a $50,000 balance when little Johnny or Susie reaches 18, they can buy a car with the money. Or travel with it. Or pay for college. It’s their call and you cannot do anything about it. While we all like to think that we are raising little angels, the truth is, that may not be the case.

529 Plan

A 529 Plan is a way for parents to save for their child’s college education. There are two main types of plans, a prepaid program and a savings account. Here, I am referring to savings accounts.

With a 529 plan, you make the contributions and the money grows tax free. When the money is withdrawn from the account, no taxes are paid assuming the money was used for qualified educational expenses. These expenses include tuition, fees, books, supplies and equipment, and reasonable costs of room and board (for those that are enrolled at least half-time).

You can contribute as much as you like to a 529. While this sounds great, any contributions that total more than $14,000 in a given year may be subject to the gift tax.

Benefits of 529 Plans

The main benefit is that the assets in the account are not the child’s, therefore they do not count against them at the child rate when applying for financial aid. This is because the child is a beneficiary of the plan, not the owner of the plan. If a parent is the account owner, the assets will be included as a parental asset (which is about 15% lower than the child rate). If a grandparent or another person is the account owner, the assets will be excluded from the calculations.

Another benefit is that you can change the beneficiary of the plan. Let’s say you have the account for little Johnny and he decides to not go to college. All you have to do is change the beneficiary from Johnny to Susie and she can use the money for college. You can even change the beneficiary to your niece or nephew if you want to.

You can choose whichever state plan you want. Each state has its own 529 plan. Contrary to popular belief, you can open up any state plan. So, if you live in Florida you don’t have to open up the Florida 529 Plan. Also, if you live in Florida and use the Florida 529 Plan, your child does not have to attend school in Florida. They can go to any college they would like.

Another benefit, just to emphasize the above, is that as long as the money being taken out of the account is for qualified educational purposes, no tax is paid.

Finally, some states allow you to deduct contributions to 529 plans on your state income tax.

Drawbacks of 529 Plans

If the money in a 529 is withdrawn for non-qualified educational expenses, it is taxed and is subject to a 10% penalty. There are some exceptions to this penalty. You can find the full list of them on the IRS website.

Each state has its own 529 Plan. Some are much better than others. This makes it confusing when trying to pick which state’s plan is the best. Personally, I like the Utah 529 Plan the most because it uses Vanguard funds and has very low fees associated with it.

Final Thoughts

If you are primarily saving for your child’s college education, a 529 Plan is a much better plan compared to an UTMA account for the reasons I laid out above. Of course, there are other plans for saving for college, so you will have to assess those as well to determine which one fits your needs and goals best.

More on Kids and College

- A Comparison of College Savings Plans

- Should You Pay for Your Child’s College Education?

- Should You Save for College or Retirement First?

- 10 Ways to Lower Your Taxes with Kids

- How Do You Handle College Advantage 529 Plan Taxes?

- Things to Consider When Saving For College

- Financial Strategies for Infants and Young Children

When I was growing up, my parents established a UGMA and invested it in a mutual fund TWCUX. It was a lousy technology mutual fund that in the 10 years or so I had money in it, the value of it never changed much. It did help pay for my college tuition, however.

“The main benefit is that the assets in the account are not the child’s, therefore they do not count against them when applying for financial aid.”

Are you sure about this ? Recently on another website they mentioned that 529 assets do count when applying for financial aid!

Hi Gana,

We’ve clarified how 529s are counted for financial aid. The quote you reference is that they are not included as a student asset at the higher rate (versus the

UTMA account which is calculated at the student rate).

However, depending on who the owner is, 529 plan assets could be included at the parental rate (which is lower than the student rate), or not at all if the account owner is not a parent.

Here’s a helpful overview of the impact of 529 plans on financial aid: http://www.savingforcollege.co.....al-aid.php

Thank you for detailing the differences between the two types of accounts. I wonder if I could use the money in a 529 account to pay for tuition for a class even if I ended up withdrawing from a graduate program?