Thinking back to my teenage days, all I was concerned about was finishing up work at my weekend job so I could drive around and hang out with my friends. I never thought about opening a Roth IRA for teens! The money I made while I worked part-time put gas in the car and provided me some spending money. I was lucky in that I drove my parent’s car and they took care of insurance and maintenance so I only had to worry about keeping the tank full. The last thing that was on my mind was saving for retirement. But now that I am older and wiser, I wish I would have started to put some money away for retirement back then. The reason isn’t only because of the benefit of time, though that is the primary reason. There are many other great reasons to start a Roth IRA for kids.

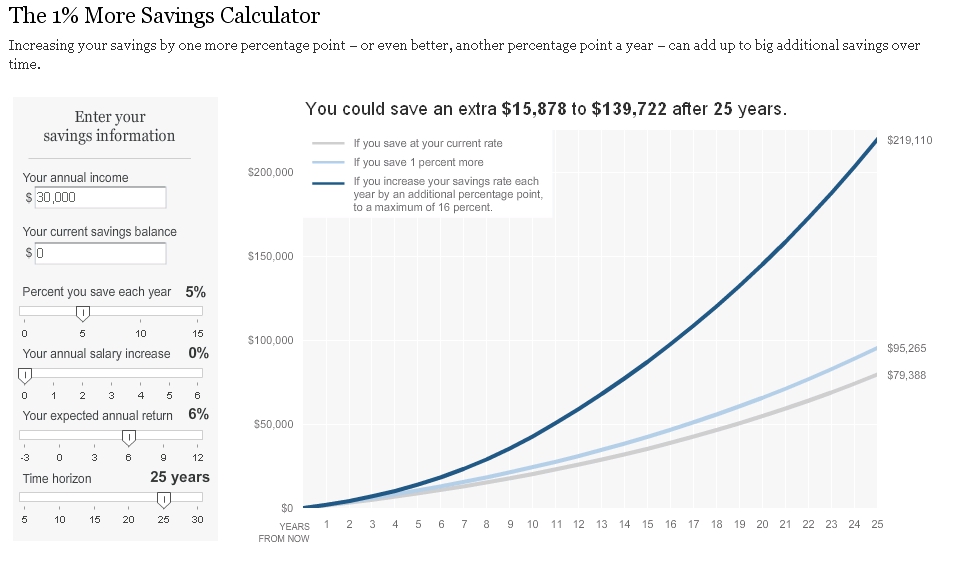

Decades of Compounding

The power of compound interest is known by many. But just to illustrate it, let’s say you contribute $2,000 per year into a Roth IRA for four of your teenage years. If you make no more contributions and it grows at 8% per year, the account will be worth over $450,000 come retirement. That $8,000 investment grew to near half a million dollars! Of course as you continue to invest in the account, the value as you near retirement will be even higher.

Roth IRA Requirements

Here are the requirements for your teen to open a Roth IRA:

- Income Requirements. Note that in order to contribute to a Roth IRA, your teen needs to have earned income. This does not include any allowance you may pay him or her. They need to have an actual job or earnings from self-employment.

- Contribution Limits. The Roth IRA Limits are $5,000 for 2012 and $5,500 for 2013. Your teen can only contribute as much as they earn, so total contributions cannot exceed earned income for the year.

- Minimum Age. There is no minimum age to open a Roth IRA.

- Contribution Deadlines. The deadline for Roth IRA contributions is the same as the tax deadline. The deadline for 2012 IRA contributions is April 15, 2013. You can open a Roth IRA for teens at any of the various online brokers.

Teaches Kids about Investing

There are numerous stories about how the younger generation is scared of investing in the stock market. Just as bad, personal finance is not taught in schools. So unless you teach your kids about money and investing, their first exposure to it will be when they are signing up for their 401(k) at their first job out of college. Many times they will put off saving then too. By the time they get around to it, they are 30 years old and wasted 15 years of compounding interest. When you take the time to teach kids about money and investing in their teens, they will be years ahead of others not just in terms of knowledge but also with money as well.

Match their contribution. You can even teach them about the benefit of the company match with their future 401(k). Let’s say your teen earned $1,000 this year. You could require her to save $500 in her Roth IRA and you will match it with another $500.

Nest Egg for a House

While I don’t encourage this option be used, it is an option nonetheless. You can withdraw money from a Roth IRA before you reach retirement age to purchase or remodel your house if you qualify as a first-time homebuyer. The reason I am against this potion is because I view your retirement accounts for just that, retirement. Your emergency savings account should be for emergencies, not for the new pair of jeans. Once you begin to gray the line of what the money in the account is for is when you start to get into trouble.

Money for an Emergency

Just like I don’t encourage the option for buying a house above, I don’t encourage using your Roth IRA for emergencies. However, the provision is there that you can withdraw contributions you make into the Roth IRA at any time without paying tax or a penalty. Note that this only applies to contributions, not earnings.

If you saved $1,000 in your Roth IRA and withdrew that $1,000 then no penalty is owed. However, if that $1,000 grew to $1,500 and you withdrew all of them money, you would owe tax and a penalty on the $500 in earnings.

Final Thoughts

While saving for retirement when you are in your teens is not your top priority (OK, it’s probably not even in the top 50), doing so teaches you very valuable lessons about money, investing and personal finance as a whole. I encourage you if you are a teen reading this or a parent of a teenager to look into opening a Roth IRA for your teen. I know it is hard with college costs right around the corner, but the investment pays off substantially in the long run.

See an example of a teen opening a Roth IRA. She used Scottrade to open the account.

What are other benefits to opening a Roth IRA for your teen? What drawbacks do you see?

More For Kids

- 10 Ways to Lower Your Taxes with Kids

- Do Your Kids Need to File Taxes?

- Claiming Dependents on Your Tax Return

- Roth IRA Q & A

- 11 Unusual Roth IRA Strategies