Meet the new writers! Over the next two weeks, you’ll get to meet all of our new writers. Our first writer this week is Don. Don writes about personal finance topics that include investing, saving, debt, the economy, and retirement. You can read more about Don in his bio. Welcome Don!

Like most investors, you probably look at a mutual funds past performance to gauge how the fund behaves. You may see a fund that has returned 10% per year for the past ten years and think that it would be nice to earn 10% annually. But as an investor in that fund, I doubt you would have seen a 10% return. In fact, I would bet that very few saw a 10% annual return. This is because the stated return assumes you invested in the fund for the entire ten years. You did not sell when the market dropped, or at any point during those ten years. For many investors, they sell when the market is dropping, either through fear or by trying to limit their losses.

Industry Proof

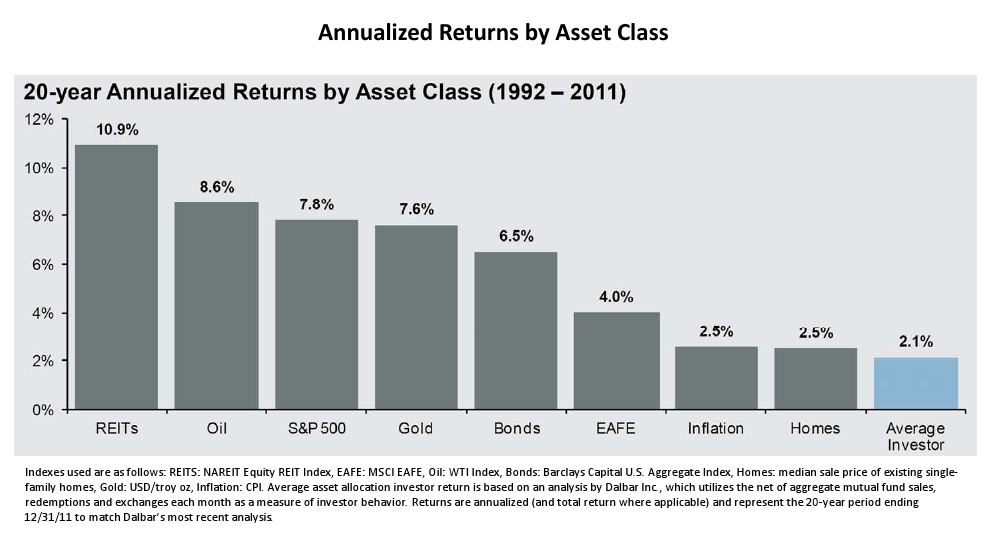

There is a company, Dalbar, that researches investor behaviors. According to a recent report, the average investor’s holding period over the last 20 years was just over 3 years. How does this affect the average investor? In the chart below, if you had invested in the S&P 500 index for the last 20 years, you would have earned a return of 7.8%. The average investors return over the same 20 years: 2.1%.

In numbers, if 20 years ago you had invested $100,000 in the S&P 500 index, your investment would now be worth $440,873. If you are the average investor that earned 2.1% over that same period, your $100,000 is now worth $151,535.

The Reason For The Difference

Why the difference in returns? Because the average investor moves in and out of the market based on short-term events. Many people sold out in the early 2000’s after the dot-com bubble burst. They didn’t get back in until after the bull market had already kicked in. Then they sold out when the market dropped in 2008 and many have not returned to the market since, missing out on a huge rally. Other investors may be jumping around trying to find a better performing security during this time. In either case, the investors are missing out on a rising market.

Three years is a very short holding period for long-term investments such as stocks. Create a well thought out investment plan for yourself and stick to it. Without it, it’s too easy to swap one investment for another. While doing so may feel good in the short-term, in the long-term, it is going to hurt you much more.

Stay Invested

Again, you need to stay invested in the market for the long-term. You cannot predict what the market will do tomorrow. By ignoring the short-term headlines, you are helping yourself. I know that it is not easy to ignore the drops in the market when news headlines are screaming doom and gloom and everyone at the office is repeating what they are saying. You need to do your best at tuning them all out. When you feel like giving in, pull out your investment plan and review it, knowing that if you follow it for the long-term, everything is going to work out in your favor.

More on Investing

- Best Online Discount Broker Comparison

- Can You Have a 401k and an IRA at the Same Time?

- Asset Allocation Update

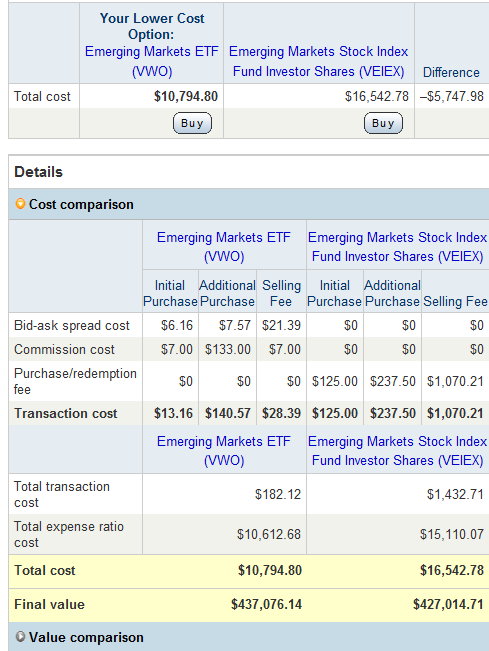

- ETFs Versus Index Funds