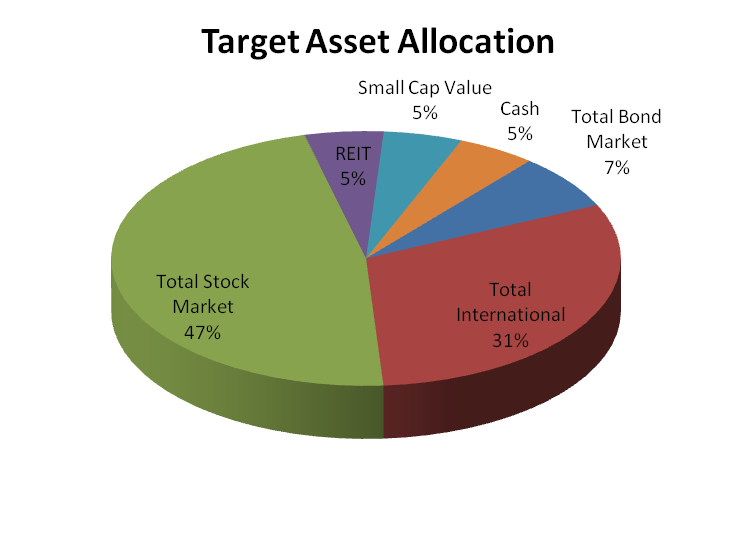

It’s that time of year again! Time when I look at our asset allocation and convince myself to take on more international exposure in our portfolio. After making the update, here’s what our target asset allocation looks like.

Update: Here is my most recent asset allocation update.

International Asset Allocation Changes

When we started using a total market approach for our portfolio I began with a 20% international (18% of the total portfolio) allocation, with plans to increase it each year.

As of our last asset allocation, I had 30% (or 27% of the total portfolio) international allocation.

Now I’ve moved it up to 35% (31% of the total portfolio). This may or may not be the final move; next year I may move it to 40%.

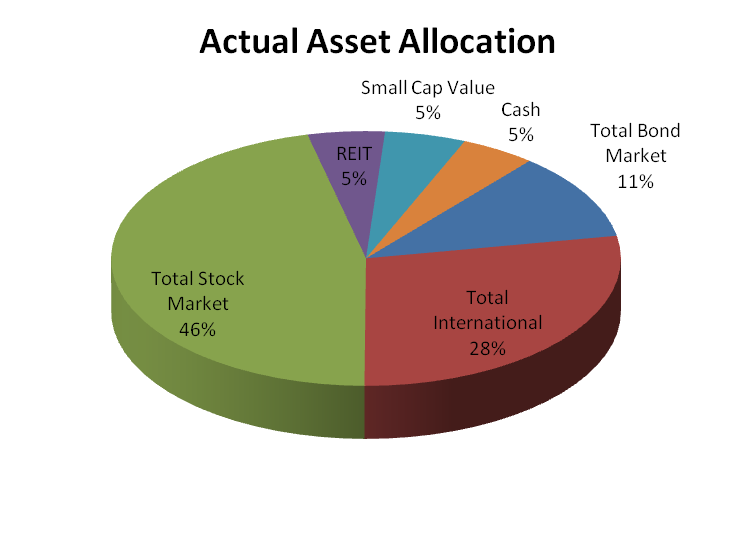

Here’s how our portfolio currently looks.

International Holdings

Our international holdings currently include Vanguard Total International Index, the BGI EAFE Index Fund, and the Vanguard Emerging Markets Index.

In addition to the overall asset allocation, I also like to keep the EAFE at 85% and emerging markets at 15% of the total international holding.

Action Plan

Rebalancing our portfolio is always fun. Since our portfolio is split over 10 different retirement accounts (which I cannot combine), in addition to the asset allocation, I try to keep it (relatively) simplified and with the lowest expense ratio possible.

I came up with a plan to shift some of the bond holdings into the EAFE fund in Scott’s 457 plan. That should account for the majority of the change.

There’s still a slight need for some additional emerging markets. I hate to buy more of the Vanguard emerging market fund, since the expense ratio is .40% with purchase and redemption fees.

I recently compared the emerging market ETF shares to the index fund, and the ETF came out on top, so I’m planning to head that route.

However, since it’s a small holding in a small account, I don’t want to pay much for the trades, so I’m going to take a look at some of my other brokerage accounts to make the move.

See our most current Asset Allocation Update.

Keep in the mind that the Vanguard Total International Index is a fund of funds, and about 24% of it is already allocated to the Vanguard Emerging Markets fund. You may have more emerging markets than you expected.

Good point Ben. I should have specified that I need the emerging markets fund to offset the holdings we have in the EAFE fund.

We have access to the EAFE fund with a low expense ratio with one of our accounts. If I didn’t have this one, I’d just put it all in the total international index.

Hey Madison,

How do you keep track of your asset allocation? I have got a rough outline using google docs (since it can automatically grab the stock prices.) Do you (or anyone else) have an accurate way of calculating it, or do you sit down and do it manually each time?

Wish I had a good method to tell you about Eric. Mine is a combo of a custom report I built in MS Money, that I export to excel and run a homegrown macro on.

Since lots of our funds (in my husbands 457 plan) don’t have tickers, it’s rather manual.

I have no idea what I’m going to do once MS Money is eliminated at the end of the year!

I can see how it would be difficult if your husband’s investments do not have tickers.

My wife and I used MS Money in the past, and given it’s robust features was quite happy with it. However, we have really been working on simplifying our overall money management system and switched to Mint. It is not nearly as helpful for micro planning, but from a macro view it works well.

Good luck with the switch to whatever you end up choosing!

Thanks for the thorough breakdown Madison!

I’m a recently employed college graduate, and a beginner investor. My savings funds are just starting out, but I would like to allocate some of my funds to investing.

Would you recommend to distribute my savings as you did here, or would you choose to invest in only a few areas?