Take Advantage of Retirement Catch-Up Contributions

If you’re over 50 and diligent about retirement savings, you may be maxing out both your 401k and traditional or Roth IRA.

But to really supercharge your savings and make sure you are extra-prepared for retirement, you should also take advantage of catch up contributions. Catch-up contributions are special provisions that allow you to contribute additional funds to your retirement accounts as you get closer to retirement. This has the double benefit of helping beef up your retirement savings while deferring taxes.

Why Catch Up Contributions Matter

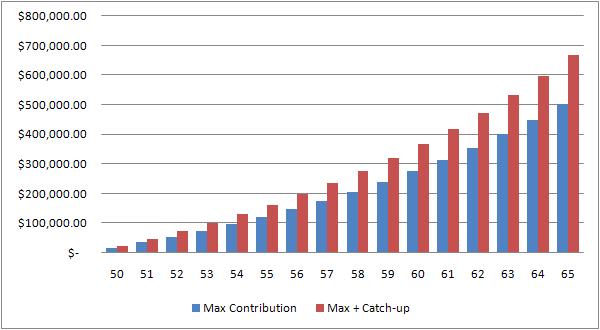

Here’s a graph showing someone who started maxing out a 401k five years ago with an 8% earnings rate; he or she would save just over $500,000 between ages 50 and 65. Someone taking full advantage of catch-up contributions would save over $667,000 in that same time period. (The contribution limits and catch up limits have gone up over the past few years so the numbers would be a slightly higher if you reran the same scenario today.)

If you withdraw 4% of your nest egg annually in retirement, that additional savings would mean an additional $6,000 of income per year.

Over 50 Catch up Contribution Limits

Most retirement accounts allow for additional contributions for account holders over 50. Here are the updated 2015 limits:

- 401(k), 403(b), 457: May contribute $6,000 above the limit of $18,000 in 2015 for a total of $24,000. Remember that the 401k catch up limit applies to the total of all 401k and 403b accounts held by one employee, even across multiple employers. 457 accounts have a separate $24,000 limit.

- Traditional IRA/Roth IRA: Up to $1,000 above the standard $5,500 maximum Roth contribution in 2015.

- SIMPLE IRA: Up to $3,000 above the standard $12,500 in 2015.

403b 15-year Catch-up

If you have 15 years of service with a public school system, hospital, home health service agency, church, or certain other organizations, you can increase your 403(b) contributions by the lesser of:

- $3,000

- $15,000 reduced by previous catch-up contributions (pre-tax and Roth) under this rule

- $5,000 times the number of years of service minus total contributions made in earlier years

The IRS explains further. Note that this applies to all employees with 15 years of service at a qualified organization, regardless of age. If you are over 50 you may take this AND the over-50 catch-up noted above.

457 Double Limit Catch-up Contribution

In the three years before normal retirement age (as defined in plan document), government and certain non-government employees may take what’s known as the “double limit catch-up.†If you did not contribute the maximum possible amount in previous years, you can contribute double the current year’s maximum amount OR the sum of “missed†contributions in previous years.

If you take this catch-up you cannot take the over-50 catch-up for 457s.

Take Action

If you want to increase your retirement savings, log in to your online account or contact your benefits coordinator at work.

I always considered the 401K to be incredibly expensive as a retirement plan. It not only taxes your investments like regular income tax (in other words, absurdly high) but for withdrawals beforehand, a 10% fee applies. It’s pretty insane.

I think the best retirement plan is to not hold your assets in a plan at all. Capital Gains Tax and Dividend tax swings immediately into a person’s favor even when held in taxable accounts.

At the least, IRA’s are far superior for retirement due to the tax breaks. Namely the Roth IRA. Between that and finding legal reductions in taxable places, would be the most tax efficient.

What makes 401(k)s a good deal is any employer match. If you are getting a 1-1 match, that “free” money more than makes up for any taxes you owe later. Plus if you are in a lower tax bracket later you pay less than if you earned the money now.

It’s also worth noting that yes, capital gains/dividend taxes are less than normal income taxes – but first you have to earn the money you will later invest, pay income taxes on earnings, then invest, then pay cap. gains taxes on gains.

Jill is right when she says that matching makes the 401(k) a good deal. However, if your company doesn’t match, you need to work harder to save for retirement.

Remember that the 401(k) is a RETIREMENT PLAN. It is not meant to be tapped into – which explains why it is taxed and penalized on withdrawals made if you are younger than 59 1/2.

The only real difference between the 401(k) and and IRA is that the 401(k) is sponsored by your employer and the IRA sponsored by you. Both offer tax deferral. For many people they may not even have a savings plan if they didn’t have a 401(k).

Check out my new book, which will be available in a couple of weeks. “Help! My 401(k) Has Fallen – And Must Get Up!” It is meant to help anyone who needs to get more from their 401(k), and written in plain English. Click on my name for more information.

Jill –

This is excellent information. Those over 50 should try to take advantage of adding the “Catch Up” contribution. The graph shows very well how the catchup can work to your advantage, with compounding returns.

My book, “Help! My 401(k) Has Fallen – And Must Get Up!” encourages all of us to save more in 401(k)s and IRAs. Please contact me for a copy soon!

Does anyone know if you are over 50 and want to contribute catch up contributions to a 401k plan how that will be viewed if you don’t reach the maximum contribution limit of $16,500? THe catch up contributions are not matched and I believe you can still make catch up contributions without reaching the max.

The law does not allow catch up contributions until after your regular deferral limit is reached.