How Diversification of Income Can Change Your Life

Most of us are familiar with the concept of asset allocation, or diversifying our portfolio. However, just as important is your ability to diversify your income.

Diversifying your income streams reduces risk and positions you against the unknowns: job loss, a downturn in the market, business failure, and more. It also gives you the chance to take advantage of new opportunities and explore your interests.

Recently we highlighted that 65% of self made millionaires have three streams of income. How many income streams do you currently have?

Multiple Income Streams Can Change Your Life

Diversifying income reduces risk. As we’ve seen many times in previous years, sometimes one income stream will cover our entire yearly budget. In addition, since we’re making some big changes when my husband quits his job later this year, having a diversified income also reduces our need for withdrawals from our portfolio. Even though it was a goal of mine, I don’t know if I would have ever felt completely comfortable with both of us leaving our jobs if we didn’t have such a diversified portfolio of income. The risk reduction from diversifying our income enabled us to change our lives!

Income Diversification

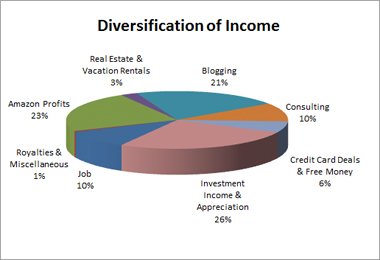

We made a goal to work on diversifying our income years ago. Over time we’ve added multiple income streams. If you are looking for ways to diversify your income, here’s what our income distribution currently looks like for some inspiration:

Job. My husband’s job is currently listed in our income stream while he works part-time. As you know, he is quitting this fall. Next year, I will remove this income stream.

Amazon Profits. I Made $100,000 Selling on Amazon Last Year. It was great to crack the six figure mark; however, for this income analysis I included only base profits that weren’t reinvested. I want the income to reflect only money that would be available to us for personal spending.

Real Estate & Vacation Rentals. We own a few rental properties. In addition to the real estate investing, we also still own our vacation home. The vacation rentals last year were positive, so while we don’t see much income from it, it does offset the cost for us to vacation there. However, the Vacation Home Tax Rules are not very favorable for our situation. For those of you who also own real estate, feel free to jump in on the How to Calculate Real Estate Investment Returns discussion!

Blogging. I still make money from advertisers on this website and a few others we own. I’m not very popular with advertisers since I write about all the ways to maximize deals and take advantage of free money, but I still love it!

Royalties & Miscellaneous. I also earn royalties from some writing that I did years ago. Royalties are great since you keep earning money, but don’t have to do any additional work! In addition, I still have some residual income from the tax business that I started years ago.

Consulting. My husband spends most of his time on his blog consulting business. As his job winds down, I expect he might take on some additional clients and this income stream will go up.

Investment Income & Appreciation. I track our investment income (interest, dividends and capital gains) and return on investments, since it’s our primary source of income if we decide to scale back on the other income streams. For our budget though, I ignore the income and appreciation and use only SWR.

Credit Card Deals & Free Money. This is my favorite category. It includes all of the free money offers I sign up for, including credit card sign up bonuses and cash back. It also includes online cash back and all the other deals I like to take advantage of. I’ve tried to make a better attempt at tracking this category of income since it’s become more lucrative over the years.

Action Plan

I looked back at our old income diversification plan from over seven years ago. My first step was to reduce our jobs to 50% of our overall income and create a plan to make that happen. For long time readers, did you work on diversifying your income? If so, how is your progress? If you are new to the idea of income diversification, what is your first step?

How do you diversify your income?

I’m also trying to diversify income streams in an effort to get my “passive” income up to the minimal expenses. This should help with my eventual goal to start my own business, or write full-time, neither of which I can afford to do until I have sources of income besides my current FT job.

Great article! People often talk about diversifying your investments, but you don’t see near as much on doing the same with your income. I think it is just as important. I concentrate mostly on increasing my investment nest egg and I am just beginning to see a trickle from my blogging efforts. I am going to continue to grow both of these.

Quite a good concept of looking at your income streams. I am doing the same, but never thought about keeping track of exact percentages (I should do it though).

What’s the business producing 5% of your income by the way?

I love the illustration. You have really good/fresh perspective on things. Love the article.

@ The Shark: The business includes a few different ventures: this site and some freelance work. We also have plans for two additional “arms” of the business that are still in the works.

Great tips and explanation of the concept

Was curious how the credit card arbitrage was working for you? I’ve read about it and some people seem to make it work.