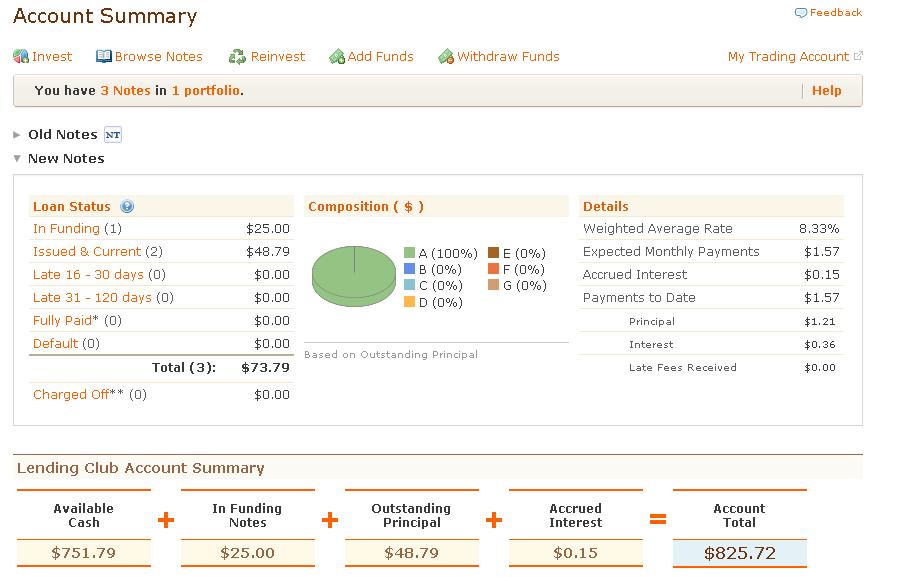

I recently asked How is your Lending Club Account Doing? after seeing my net annualized return on investment at 8.44%.

I enjoyed reading readers’ responses about their portfolios at Lending Club and wanted to share them. It’s fun to see how everyone stacks up and what their portfolios look like.

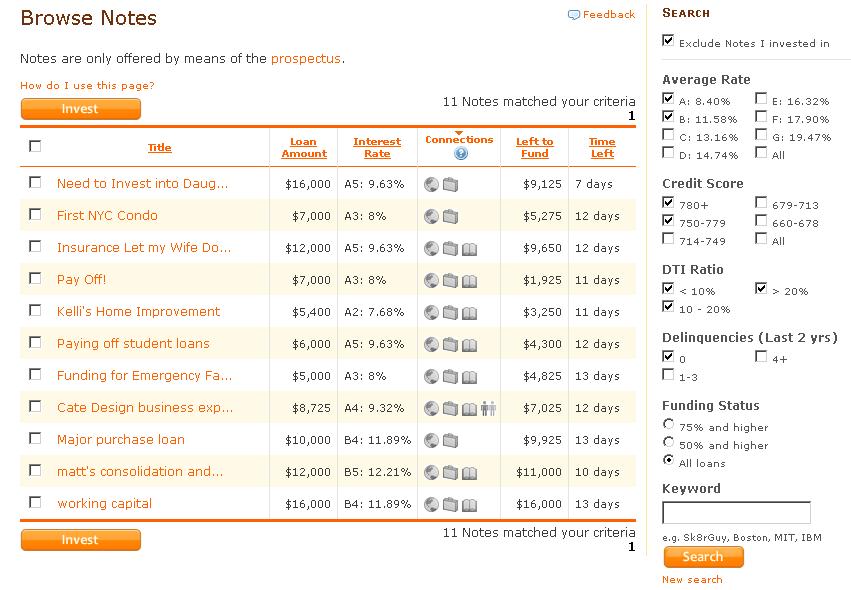

What I find particularly interesting is that many readers are taking the time to look at what the borrower wants to do with the money, rather than just looking at the interest rates.

Readers’ Lending Club Returns

- 14.46%. All current. One loan is an A, but the others are D or E. I let Lending Club pick the loans for me. – Dough Roller

- 12.15%. 11 loans, all current, one grade D paid off early. Portfolio is A (36%), B (8%), C (28%), D (20%), and E (8%). I’m still relatively early into the terms so the fact that they are all current isn’t a huge surprise, but I expect one of the 12 notes I took out will eventually default. Selection based on how much they were asking to borrow and for what purpose. – Jeremy

- 11.47%. 20 loans, all current, 3 months in. Generally, if I invest in a D, E, or F I read the reason they need the money, and usually only go in on small sums less than $5,000. I keep a pretty balanced portfolio across all the percentages with enough A’s to balance out my higher risk investments. I’m trying to get my portfolio to a point where I’m getting paid at least $25 per month so I can reinvest in other loans. – Jenny

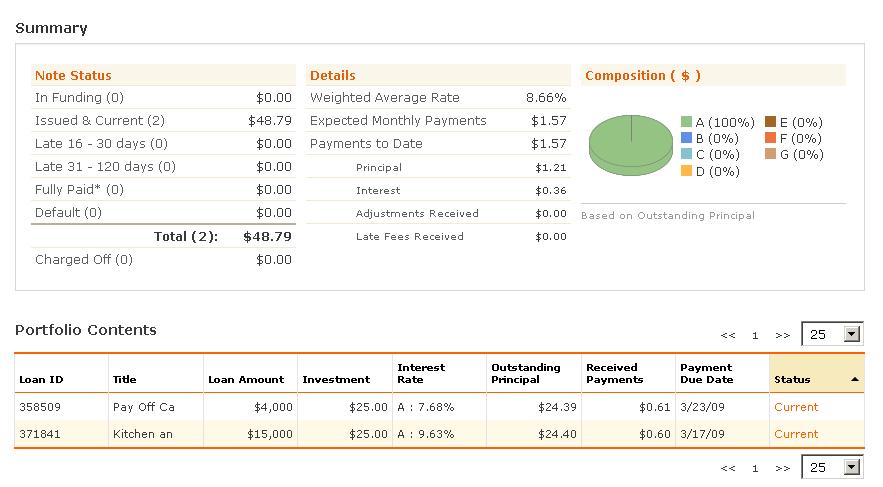

- 11%. 2 loans, both current. I’ve only dabbled in social lending. To spread my risk out a bit, I balanced investments in Lending Club borrowers between a medium-risk borrower with a low-risk borrower. – Frugal Dad

- 10.57%. All current. Mostly A loans that I selected myself, but a couple low quality “gambles” too. – Rocket

- 10.18%. 4 loans, all current, 1 borrower is paying extra every month. I know that means I don’t get to earn interest off him or her, but I’m happy to see their progress in paying it off early. Makes me think I invested in a really good person who has their stuff together. This is why peer to peer lending is better than banks. I really, really care about investing in good people who have their acts together. Not just people who can do math. (i.e. I don’t want to finance your Sea-doo because you’re overfinanced on your truck). – Jessica Ward

- 9.64%. 2 loans, B grade, both current. I picked the loans myself and asked a question of one of the borrowers. – No Debt Plan

- 9.4%. All current. My notes are pretty old (nearly halfway through the 3 year repayment process). – Debt Kid

- 8.83%. 4 notes, all current. I just barely started. Grade A loans. I look at the reason for borrowing. I like to help people who are getting loans for business needs. – Miranda

- 8.75%. A few loans, all current, loans are about a year old. This is a small sample size though, because residents of my state are not currently able to fund new loans via Lending Club. – Patrick

- 7.34%. Over 200 loans. Investing for 1.5 years. I had a few defaults (about 10 of my loans). But gosh! What a great return after defaults and fees. I’m now investing again after they reopened and I’m never going back to Prosper. The quality of borrowers is better, and there is no drama with Lending Club (no quiet periods, no out-of-control defaults, and only good credit borrowers, etc). – LooneyMooney

- 0.74%. The return is low because I have been hit by 3 defaults from D loans that I made at the very beginning. I guess I am paying for my desire to get the highest interest rates possible. I’ve now learned my lesson. Currently, I am cautiously optimistic about peer to peer lending and continue to invest on new notes when I have a chance. – Pinyo

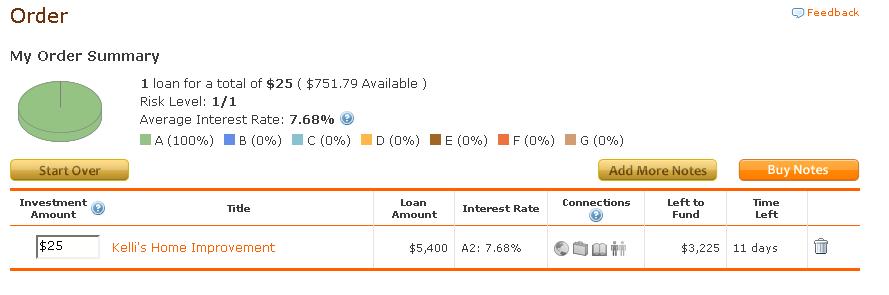

More information on Lending Club can be found in the Lending Club Step-By-Step Guide and my Lending Club Review.