Lending Club Step-By-Step Guide

My Lending Club portfolio is finally starting to take shape. If you haven’t signed up for a Lending Club account yet, here’s a step-by-step guide to becoming a lender and a sneak peak into what you’ll see once you fund some loans.

For all the details on minimum investments, interest rates, and requirements, see my full Lending Club Review.

Become a Member

The enrollment process is easy, just sign up for an account at Lending Club. First you’ll enter your sign-in information. Lending Club will then send you an email to verify your email address. You can then enter your personal information. The process was easy and quick!

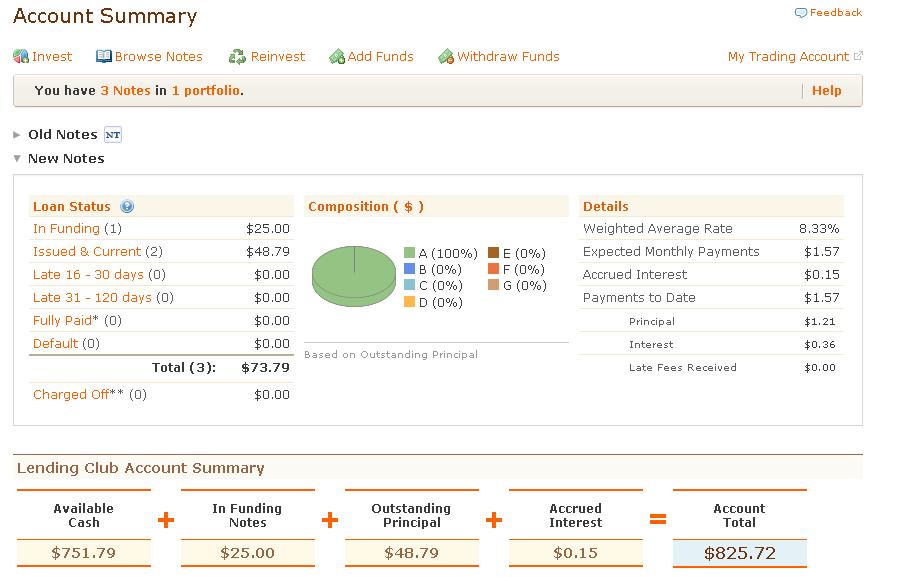

Account Summary

Your account summary is essentially the dashboard where you can monitor everything going on in your account. You’ll be able to see at a glance how much cash you have available to invest, the status of your loans, and a breakdown of the loans. (Click on any of the pictures to make them larger.)

Investing in Loans

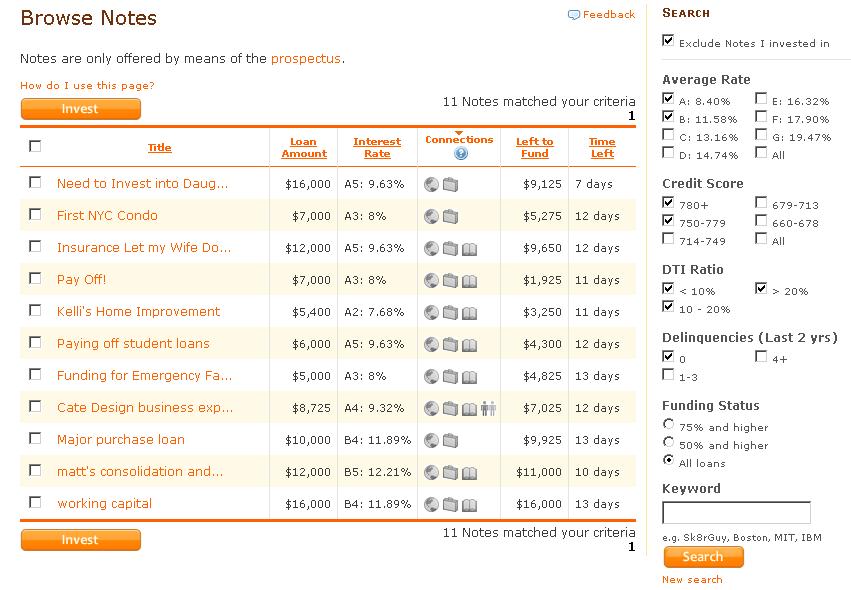

Once you’ve signed up, there are two ways to shop for loans. You can browse for individual notes or use a targeted portfolio.

To shop for individual notes, narrow down your criteria with the search options on the right. I selected the interest rates (A&B), credit scores, debt-to-income ratios, and delinquencies that I wanted to look for loans that will have a better success rate (although lower interest rate).

When you see a loan that interests you, click on it to read details about the borrowers employment, what they plan to use the money for, and more details. You can also ask the borrower questions about their intended loan.

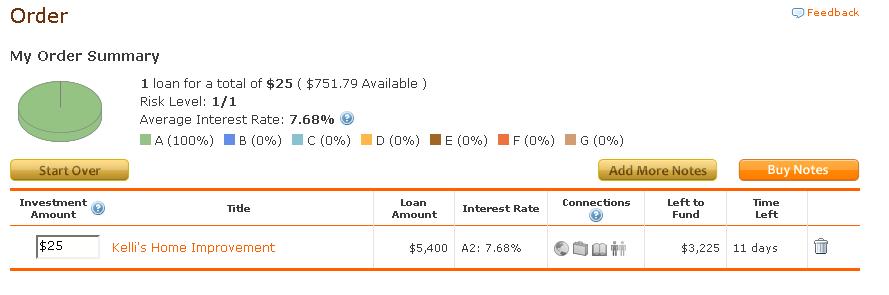

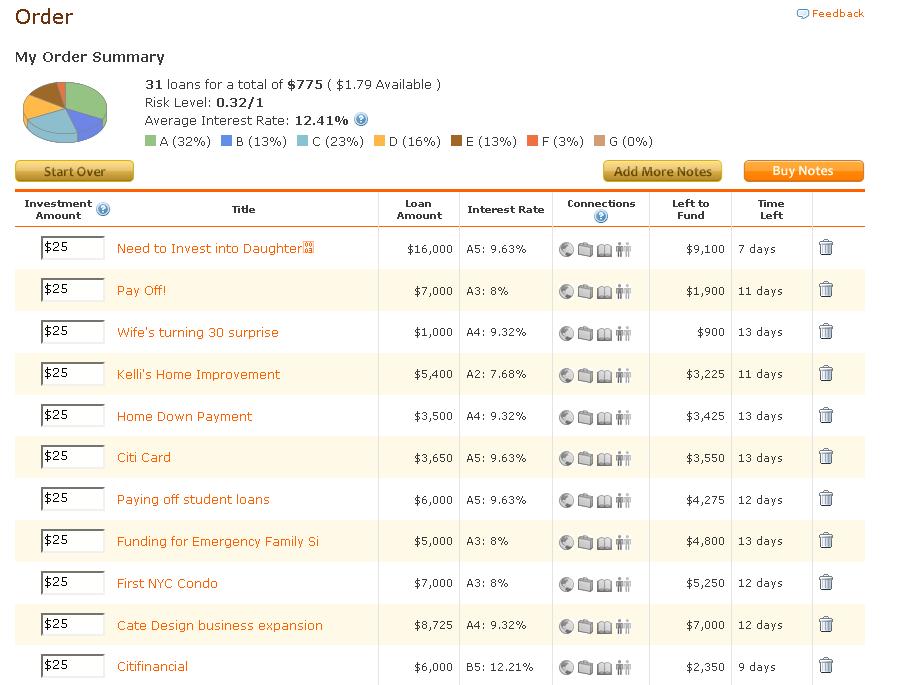

Place Order

Once you’ve selected your notes, you’ll see the order summary screen to place your order. Buy the note, and you’ll see it move to the “in funding” status in your account summary.

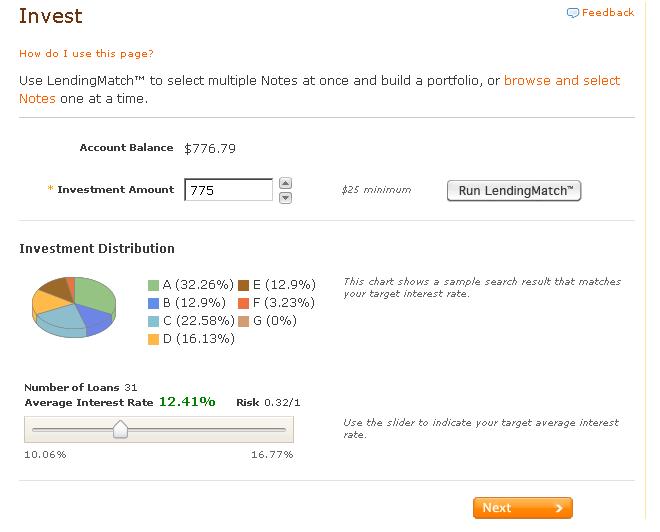

Portfolio Lending

The other option to search for loans is to use Lending Match, to select a bunch of notes at once. Use the slider to select your interest rate and click run.

Your order screen will populate with a mix of loans that together will meet your intended interest rate. However, you do not need to purchase all the loans on the order screen; you can review each loan just as you did before and choose whether or not to include that loan.

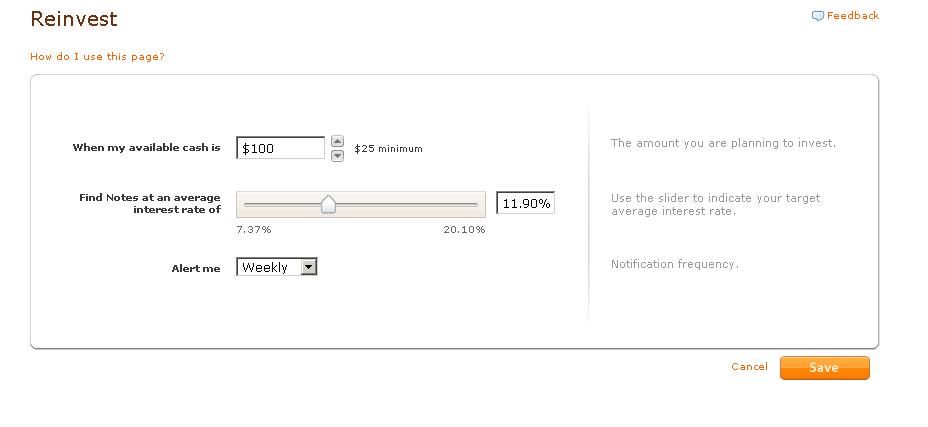

Reinvest

Once you’ve selected loans, you’ll receive interest each month from your borrowers. To avoid having to go in and purchase more loans from time to time, you can use the reinvest option to purchase loans for you. Select the amount, interest rate, and time frame and the rest will be done for you!

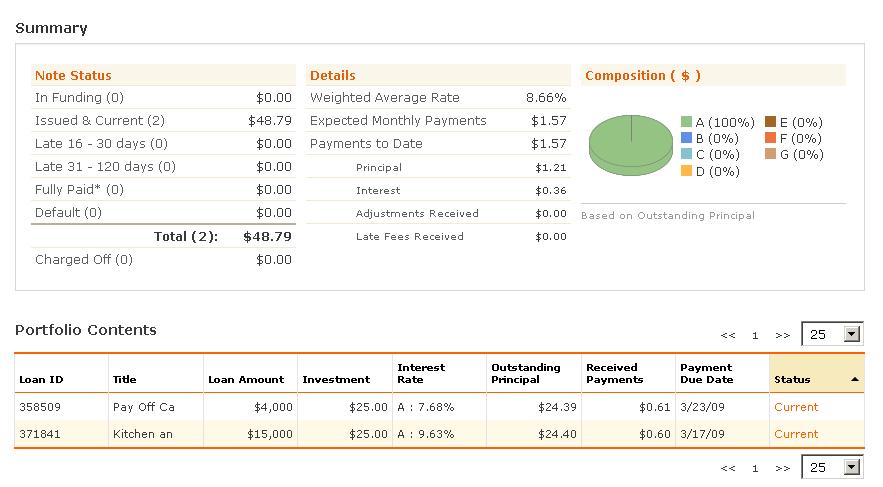

Portfolio Contents

After you’ve invested in notes, you can use the portfolio contents to see the portfolio summary, similar to the account summary, and a list of loans that you are invested in. It’s a good way to see which loans are current and the details for each.

Lending Club

I’m having fun with Lending Club, and I’ll continue to monitor how my portfolio does. Eventually, I might try a loan with a higher interest rate, but for now, I’m going to stick to the borrowers with less risk.