You Need a Budget Review

Many of you with an interest in personal finance have probably explored various budgeting strategies and tools that can help make the task a bit easier.

One popular program is You Need A Budget (YNAB), a tool that promises simple, easy-to-use software and a money management methodology.

I recently took a look at YNAB Pro and really liked what I saw! You Need A Budget has four main principles that it encourages as a way to financial peace:

- Stop Living Paycheck to Paycheck

- Give Every Dollar a Job

- Prepare for Rain

- Roll with the Punches

YNAB Basic Versus Pro

One of the first things you’ll notice on the You Need A Budget website is that there are two versions of their product offered, Basic and Pro. The YNAB Basic version is $24.95 and the YNAB Pro is $49.95 and you can either download the software or request a hard copy. Unfortunately, Mac users will have to stick with the Basic version for now because the Pro version is not yet available.

Some advantages of the Pro version are that it allows you to import transactions from your bank and automate recurring entries, and also offers unlimited budgeting categories and auto-suggested budgeting features. It also has built-in reporting and lets you enter a single receipt and split it up among different budgeting categories which can come in very handy.

Register

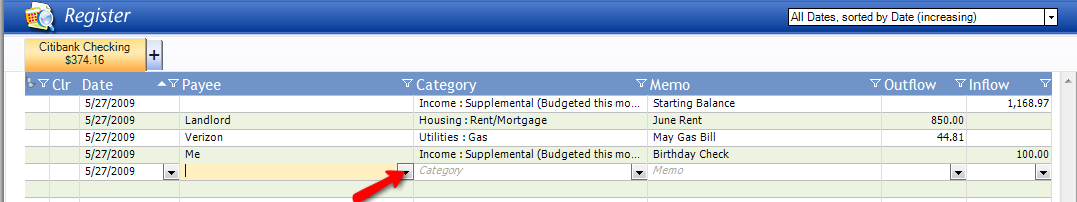

The first YNAB section is the “Register,” which allows you to store all of your financial transactions from multiple accounts, including checking and savings accounts, and credit cards.

You can download data from your financial institution and import it here or you can manually add entries, which may be most effective for cash transactions. The most important part of this section is correctly categorizing your entries (i.e., Food: Groceries, Food: Restaurants, Recreation: Entertainment), which is the basis for the rest of the You Need A Budget program but unfortunately can take quite a bit of time at first.

(click on the images to expand them)

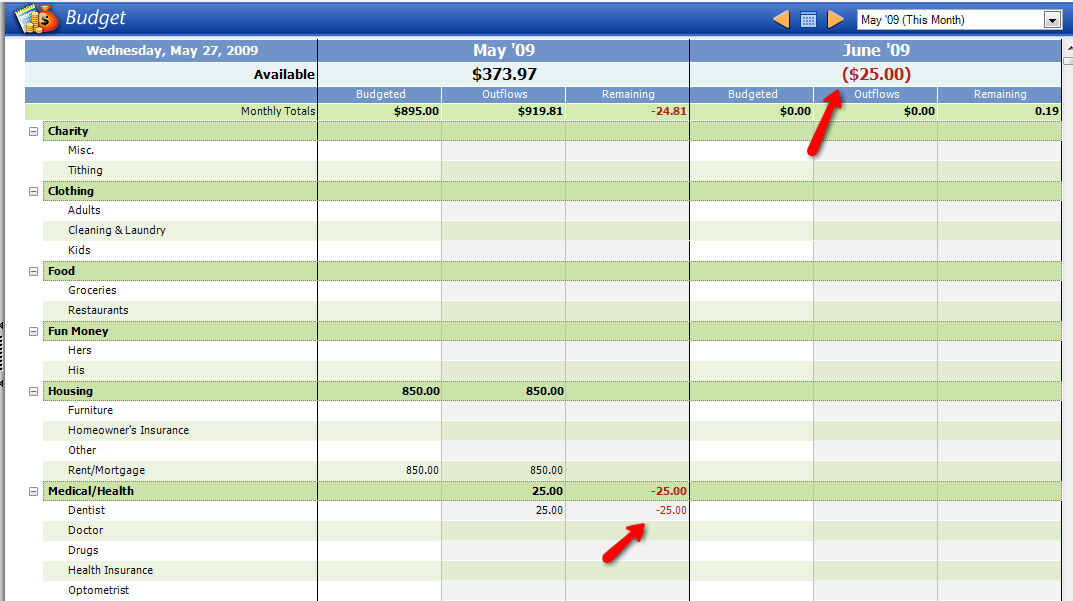

Budget

Once you have organized and categorized all of your transactions in the Register, you can click over to the Budget tab to see your total expenditures from the time frame that your data encompasses. What’s so great is that every individual transaction is now rolled up so that you see the total amount you spent in each category for each month, i.e. total “Food: Groceries” in April. Having this information from the past couple of months is a great way to form a budget that you want to stick to for the coming months.

Now, for upcoming months, you can establish a baseline budget of the amount you expect to spend in each category and mark it under the “Budgeted” column. You Need A Budget will automatically calculate the “Remaining” amount that you have left to spend in each category and overall for the month. As each future transaction is registered and categorized, your monthly surplus or deficit is clearly displayed.

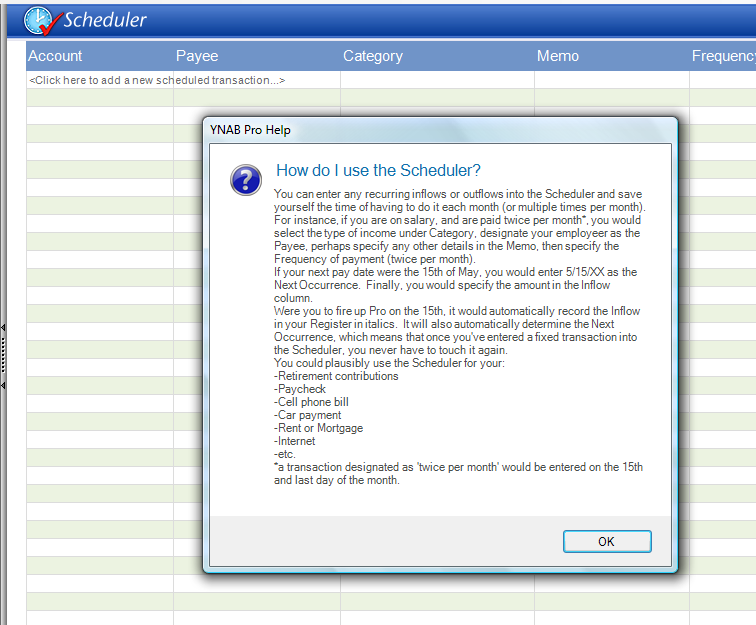

Scheduler

The “Scheduler” section of You Need A Budget is a convenient way to lessen the amount of manual entries you have to make. Recurring elements of your budget, i.e. a paycheck, a mortgage payment, car insurance, etc., can be scheduled here so that you don’t have to enter them each time they actually do occur.

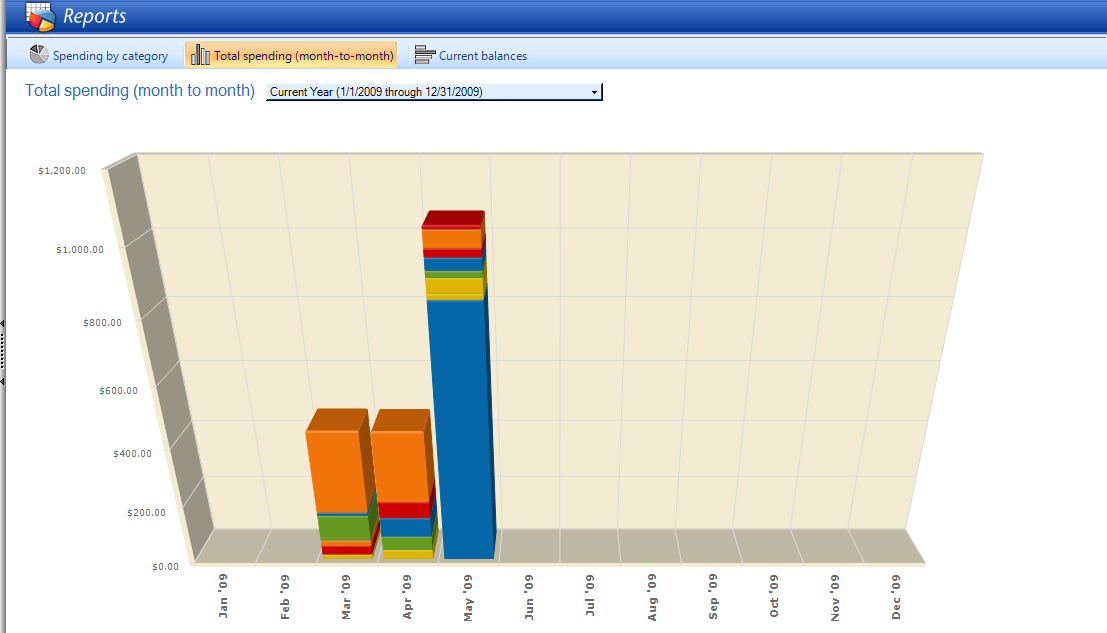

Reports

And now for the fun part! You Need A Budget lets you take all of this information that you’ve entered about your spending and income and make some sense of it in pictures: charts and graphs. I thought this section could use some flushing out in terms of more ways to view your data but I think the “Spending by Category” pie chart is awesome. It’s such a great way to see where your money is going each month. The “Total Spending (month-to-month)” is also a great way to see fluctuations in your monthly spending, both overall and by category.

You Need A Budget

You Need A Budget is a great tool for anyone looking to get their finances better organized. Those who are familiar with Microsoft Excel will especially like the familiar format of the “Register” and “Budget” screens.

YNAB will also appeal to those who feel uncomfortable giving a budgeting tool access into their accounts and prefer a program that sits on their desktop. However, because YNAB does not receive a feed from any financial institutions, the process of entering every single transaction can be very manual.

This provides very good encouragement for keeping track of every penny though! I also found the “Help” menu on the left-hand side of the screen very handy.

Do you use You Need A Budget? How do you like it?

I use http://www.mint.com which a cool site which does the same thing. But if you have concerns of giving away your account information, YNAB will be a better solution.

I’ve used YNAB seriously since August 2008. At the time, DH & I were $37K in debt, behind on a lot of bills and in a pretty precarious financial position. YNAB was the shot in the arm we needed to really implement zero-based budgeting. I can’t credit YNAB enough for the ease of use features and its ability to instill an intuitive budgeting approach to folks who had been trying very hard to get on a budget but just failed time & again. I use pro and the first few months it was fairly labor intensive, as we were trying to document and track the leaks in our budget…so every transaction was a manual input. Now things are running more smoothly, so we do cash envelopes for some of the frequent expenses and don’t track to the penny, and do imports from our banks 2 or so times per month. The YNAB folks are releasing a 3.0 version soon with MUCH more functionality, and I’m about as excited as all these iPhone addicts were last week! Oh, and since we implemented YNAB & 0-Based Budgeting, we’ve paid off more than 50% of our debts (non-mortgage debt that is) and we have $5000 in the bank as our buffer and baby emergency fund…

Quicken does the same thing with budgeting, even the graphs/charts. It also tracks your other asset values, such as your home and cars, and liabilities, such as your mortgage and car loans. All in one program. I have been a long time Quicken user at home and a Quickbooks user at work. Great products and customer support.

I love YNAB and can’t really think of a better way to track and handle my budget. I am also very involved in the forums where you can constantly get updates to the program as well as advice.

It is so incredibly intuitive and so affordable (one-time cost of $49.95, but you can do a search for a coupon code and get a discount). There is a 15 day free money-back trial. Get the Ynab Pro version….they are upgrading it to YNAB 3 at the end of the year. Their forums are so supportive, there is free training, and the support is unbelievable.

I cannot say enough about how great YNAB is….there’s not enough space on the internet for my thoughts!! LOL!! Read the reviews on AMAZON also….if that helps.