Is There a Student Loan Crisis?

Dominating the news headlines currently is the topic of student loan debt and a possible student loan crisis. For the first time ever, the total amount of student loan debt has surpassed the $100 billion mark. This is more than consumer credit card debt and is second only to housing debt (mortgages). Many experts are saying that the next bubble to burst is the student loan bubble. Below I present a few reasons why the so-called student loan bubble isn’t really a bubble at all.

More Students Are Going To College

More people are going to college to get an education. As a result, more people are going to be taking out student loans. According to the National Center for Education Statistics, college enrollment from 1990 to 2000 increased 11%. From 2001 through 2010, enrollment jumped 37%. This includes both full-time and part-time students. It appears that everyone is buying into the message that you need to go to school to get ahead. I am not going to argue for or against this point; I am simply saying that more people are going to college. That 37% jump in the last decade correlates to 5 million students.

Let’s just say for argument sake that only 500,000 of these students needed to take out student loans and each one took out a loan of $20,000 total. That’s $10 billion right there. I’m sure many more than 500,000 took out student loans.

Average Student Loan Debt Isn’t High

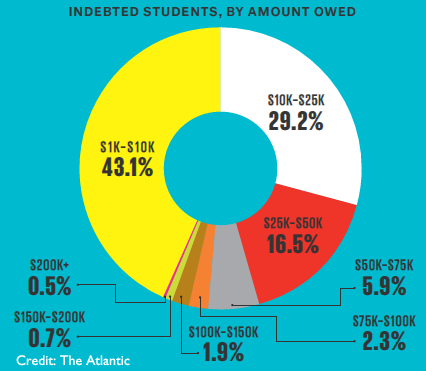

You may argue about how much student loan debt college graduates have when they finish school. I’ve read the stories of the girl with $120,000 in student loan debt working at McDonald’s. You have to realize that this story is the exception, not the norm. The media is playing into your emotions. In fact, 43% of students have between $1,000 and $10,000 of student loan debt. That girl in the news I mentioned above, she and others like her account for roughly 3% of student loan debt. See the chart below.

When I graduated from college, I had about $12,000 in student loan debt. Most of my friends had the same. I don’t know anyone who had over $25,000 of student loan debt. This doesn’t mean that it doesn’t happen, but it just furthers the point that huge amounts of student loan debt is not the norm, it’s the exception. If we look at the chart above, we can see that students with student loans up to $25,000 make up over 72% of the total student loan debt. This is saying that close to three quarters of all students that have student loan debt have $25,000 or less. When I see my friends and people I know that have had this amount of student loan debt, we are all doing OK financially.

College Graduates Do Have Jobs

While the unemployment rate for the nation still hovers around 8%, for college graduates the unemployment rate is under 4% as of November 2012 according to the Bureau of Labor Statistics. The peak unemployment rate for this group was just over 4%.

Now granted, this does not take into account those that are underemployed or those that have completely given up looking for a job. If we look a little deeper into the statistics, the average weekly earnings of a college graduate are $797. A $25,000 student loan that has to be repaid in 10 years and carries an interest rate of 6.8% has a monthly payment of $287 per month. If you are making close to the average earnings mentioned above, you should have no issue making your monthly student loan payment. See 6 Mistakes of New Earners and How to Fix Them if you are struggling to meet your obligations.

For those that are underemployed, student loans are more generous in terms of payback options. If you have federal loans, you can stretch out payments to 20 years and you can defer payments or forbear payments as well. You can even take part in a new income based repayment plan called pay as you earn where your payment will increase as your earnings do. In addition, for public service workers there is a student loan forgiveness program. The point is, if you have a monthly student loan bill of $300 and you cannot afford it, you should contact the lender and work something out with them. Since student loan debt cannot be discharged in the event of a bankruptcy, lenders are more open to delaying payments because they know they are getting paid regardless.

Where The Student Loan Crisis Is

For the majority of students, there is not student loan debt crisis, as I pointed out above. Where the crisis is though, in my opinion, is hidden in the above numbers. The number of people going on to college is increasing each year. This is a good thing, as a more educated work force is a more productive work force. The problem though is that a healthy part of this group is from low income families. These families tend to not attend the typical four-year non-profit college that most go to. They instead go to the for-profit colleges who in some instances mislead potential students into thinking they will be earning a high salary once they graduate and saddle them with student loan debt that they will have a difficult time repaying.

I think the media should focus on this aspect as this is the real crisis. We need to educate these young people so that they understand what they are getting themselves into. They are blinded by the fact that they are the first one in their family to ever go to college and end up getting hurt. By helping these people out through educating them on student loans and what they can expect once they graduate will go a long way in bettering their financial future.

Final Thoughts

I don’t want this post to come off sounding as though I don’t think students are in trouble when it comes to repaying their debts. As I pointed out, I think that the majority of graduating students can handle their student loan repayment and that the media really is blowing smoke. I just want you to think about what you hear in the media and not take it for face value, but to question it and look into it. Yes, for the first time ever, total student loan debt has surpassed $100 billion. But is that really a bad thing? It shows that more people are attending college and continuing the lifelong pursuit of knowledge. And according to the chart I showed you, the majority of students don’t have a significant amount of student loan debt either. So why worry about a problem if it really isn’t the problem? By breaking the numbers down we can see what the problem actually is and hopefully we can make strides on correcting it.

What are your thoughts on the student loan bubble the media is currently hyping?

If there is a student loan “bubble” its effects will be different than other bubbles, simply because of the unique nature of student loans. So it’s not a bubble in the same sense.

The main economic effect I would think would be to crowd out other economic activity, ie if you are paying off student loans, you aren’t going to be taking out other loans for a car or a house as early as prior college graduates who completed college with better job prospects and less/no debt.

There’s also an effect on the jobs market, when an underemployed college graduates take a job that doesn’t require a college degree, that means there is one less job available for someone who didn’t go to college and would otherwise qualify for that job.

If you are unable to find work, then you have options as noted in the article, but won’t interest pile up?

Also, it is very misleading to quote overall unemployment rates of 4% for college graduates in the context of student debt that /recent/ college graduates are facing. It’s relatively easy to find official statistics that paint a different picture, for instance from the Department of Labor:

“Men who had earned bachelor’s degrees in 2011 had an unemployment rate of 16.1 percent in October 2011, compared with 11.2 percent for their female counterparts.”

If the economy were better, there wouldn’t be talk of a student loan bubble, because there would be enough well paying jobs to support paying back these loans.