We frequently discuss the impact of credit inquiries on credit scores whenever I write about our latest credit card application spree.

What we haven’t discussed before is how much a late payment will affect your credit score. I never had the perfect data point to share… until now!

How Much Does a Late Payment Affect My Credit Score?

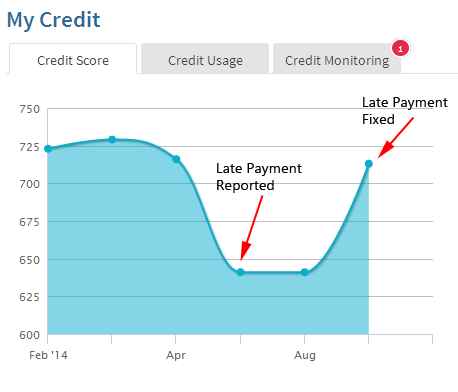

I’ll cover more details about how I got the late payment (and how I also got rid of it) below, but first let’s look at the impact. Here’s a picture from my Credit Sesame account:

How much does a late payment affect my credit score?

How Much Will One Late Payment Affect My Credit Score?

As you can see, my score was 716 in April, and dropped 75 points to 641 in July when the late payment showed up. As soon as I got the late payment removed, the score went back up. I reviewed my report and there weren’t many other factors that changed significantly during that time.

How to Monitor Your Credit for Late Payments

Credit Sesame offers a free credit monitoring service. That service turned out to be a very valuable way to monitor my credit report.

Years ago, we highlighted that you could get your free credit score from Credit Sesame. I signed up and forgot about it.

Here’s the credit monitoring email I received that caught my eye:

When I logged in and looked at the detail here’s what I saw:

Late Payment Removal

It turns out the late payment was on my Barclaycard Arrival Plus card. After I cashed in the $400+ sign up bonus, I changed my card to the Barclaycard Arrival card with no annual fee. There was a mix-up in the electronic billing when the account number changed and I never received the final bill. Then they reported the payment as late.

After a phone call to clear it up, they took responsibility for the error and removed the late payment from my credit report.

I was really pleased that Credit Sesame caught the late payment and sent me an email right away! Not bad for a free service… thanks Credit Sesame!

Do you use Credit Sesame or another credit monitoring service to monitor your credit report?

More on Your Credit

You can get my latest articles full of

valuable tips and other information delivered directly to your email for

free simply by entering your email address below. Your address will never be sold or used for spam and you can unsubscribe at any time.