What is the Mortgage Interest Deduction?

The mortgage interest deduction is beneficial to many homeowners when they are filing their taxes. Even though many take this deduction, most don’t fully understand it. I am going to do my best to keep things simple as I explain the important aspects of the mortgage interest deduction as well as how to claim it on your tax return.

Mortgage Interest Deduction

For starters, the mortgage interest deduction allows homeowners to deduct the interest paid on their mortgage when they file their taxes. But not everyone can do so. In order to qualify for the deduction, you have to meet the following criteria:

- Mortgage must be taken out after October 13, 1987

- The debt must be secured by the home

- The debt must be used to purchase, construct or substantially improve the taxpayers first or second home

- Indebtedness is limited to $1 million

- Must itemize deductions

The above criteria is fairly straight-forward. Homeowners do have to understand that they cannot deduct interest paid on a third home, unless that third home is used for business or is an investment property.

When it comes to refinancing, the IRS looks at this action as debt used to purchase a home. Therefore if you refinance, you can still deduct the interest you pay on the loan.

Also note that the debt must be secured by the home. This means that you have to be named on the debt in order to write off the interest. Therefore, if you are a secondary note holder of the mortgage, you cannot write off any interest you paid on the home since you are not named on the debt.

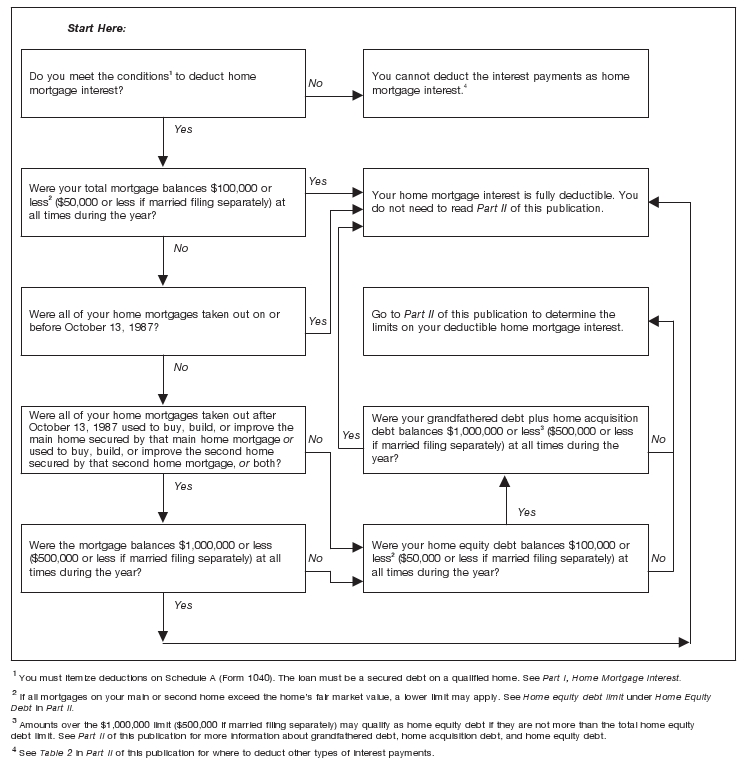

Finally, the interest on home equity debt is deductible up to the first $100,000. There is no requirement that this debt be used for purchasing, constructing or improving the home. This is why so many people take out home equity lines of credit to buy cars and pay down credit card debt. It turns the interest paid from not being deductible (credit card and auto loan interest cannot be deducted on your taxes), to being deductible. I am not recommending this strategy because if you default on your car loan you are only out your car. If you default on your mortgage, then you risk losing your home. To determine if you can deduct interest you paid on your mortgage, see the IRS flowchart below.

How to Claim the Mortgage Interest Deduction

Every year, assuming you paid $600 or more of mortgage interest, you will receive a Form 1098 from your mortgage company. On this form will be listed the amount you paid in mortgage interest for the prior year. You take the number listed on this form and use it to complete Schedule A of Form 1040, line 10.

For many homeowners, this deduction is taken when you are in the early stages of home ownership. This is due to the fact that for many of the first years of home ownership, your monthly payment goes predominately towards interest. As you reach closer to the payoff of you mortgage, you pay less towards interest and more towards principal. It is in these years when you will not be taking the mortgage interest deduction because the standard deduction will be higher, assuming you have no other itemized deductions.

What About Points?

I am briefly going to talk about points. I say briefly because as with anything IRS related, there are numerous exceptions. Points are charges paid by the borrower to obtain a mortgage. The most common example of points is if you are quoted with an interest rate of 4.0% with no points or 3.75% with 1 point. In this case, you pay an extra “fee†or point at closing to get a lower interest rate.

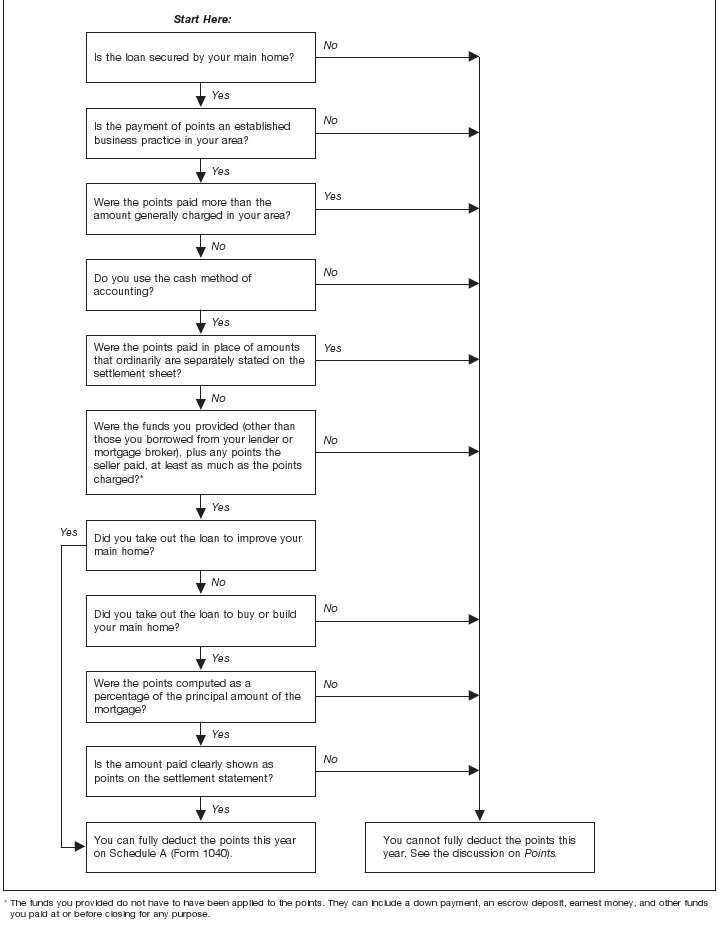

Can you deduct points? For the most part, any points you pay are not fully deductible in year you pay them, but rather over the life of the mortgage. Below is an IRS flowchart to help you determine if you can deduct points fully in the year you pay them.

Final Thoughts

This post only begins to touch the surface of the complex world of deducting home interest mortgage on your tax return. I highly suggest you visit the IRS website or read publication 936 from the IRS that covers this topic in its entirety. The PDF covers other areas related to mortgage interest and points, such as insurance premiums which are also tax deductible. There are also numerous examples for helping to guide through this complex topic.

As I mentioned before, when it comes to the IRS, exceptions are the rule. For many of the rules, there are exceptions to the rules. This is why it pays to hire a quality tax accountant so that you can take advantage of every deduction that is available to you.

I could be wrong on this, but my understanding is that if you are subject to the Alternative Minimum Tax, then this deduction (as well as most deductions) doesn’t have value. Just wanted to point that out/ask for confirmation.