Student Loans: The Effect of Extra Payments

Today we’re wrapping up our Student Loan series with a look at exactly how much of a difference a few extra payments can make!

For many people, large amounts of student loan debt are the only thing standing in the way of being debt-free. Even if you choose the standard repayment option on a small-dollar non-consolidated loan, you will be making minimum payments for 10 years. In many cases, you can double the total loan amount when taking interest into account. If you take an extended repayment option, your payments will be lower but your total amount paid will be even higher. Just like making extra payments on a 30-year mortgage can result in nearly the same results as a 15-year mortgage without the obligation, making larger payments on an extended or graduated plan can help bring your total payments closer to those of the standard repayment option. And making extra payments on a standard plan can mean student-loan freedom even faster.

Should you pay extra?

The largest argument for paying extra on your student loans is getting rid of debt and reducing the total amount of interest paid over time. Much like a mortgage, though, there are many reasons for not paying your loans off as soon as possible. For one thing, interest rates are typically low. Student loans should almost certainly be the last priority, except for maybe your mortgage, in any debt repayment plan. Those making under $70,000 ($145,000 if filing jointly) receive a tax deduction for student loan interest, so your student loan is actually costing you a little less to hold on to than you might think.

In a good interest rate environment, you might be paying less in interest than you would earn by parking your money in a high-interest savings or money market account. For instance, new loans right now have an interest rate less than 5%, which some accounts used to earn and could again in the future. And those with a higher risk tolerance might choose to contribute more towards retirement and invest in stocks or bonds rather than pay down low-interest debt.

How fast you choose to pay off your loans depends on your personal circumstances as well as your attitude toward carrying debt.

Payment amount matters

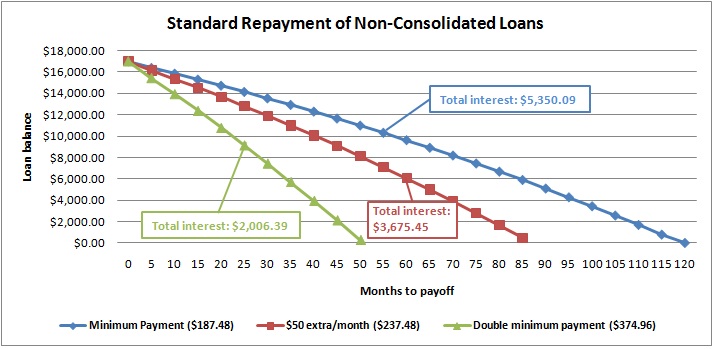

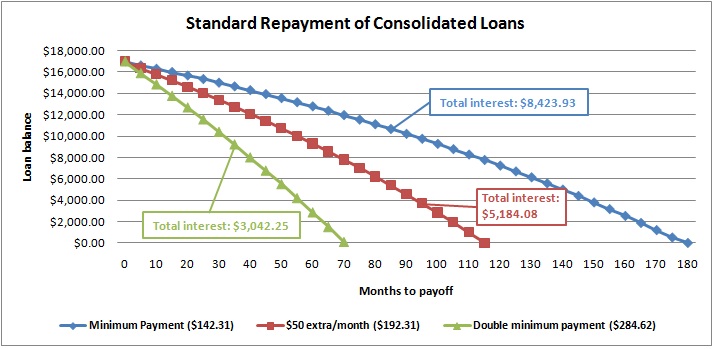

If you do think that paying more than the minimum and zeroing out your student loans ahead of schedule may be for you, the following graphs might interest you. It’s amazing what even an extra $50 per month can do for debt eradication!

For these graphs, assume that a student has one loan for each of four years of college. To keep it simple, I assumed these were all subsidized and so no interest was accrued. The balances and interest rates at the start of repayment are as follows:

- $3,000 at 6%

- $4,000 at 6.2%

- $5,000 at 6.8%

- $5,000 at 4.5%

We looked at standard payments for consolidated and non-consolidated loans. For each payment option, we looked at paying the minimum, adding $50/month, and paying double the minimum.

As you can see, consolidating your loans spreads the minimum payments out over 15 years rather than 10. If your loan amounts are higher, consolidating can actually spread payments out over as much as 30 years, significantly increasing the total amount of interest paid. Even in this case, paying minimum payments on consolidated loans can cost you about $3,000 than minimum payments on non-consolidated loans. And adding $50/month to your minimum payments saves you $3,000 on consolidated loans and about $1700 on non-consolidated loans. If you are fortunate enough to be able to double your minimum payments, you can pay off non-consolidated loans in just over 4 years! And doubling your consolidated minimum payment will still help you eliminate your student loans in less than half the expected time.

The bottom line: extra payments matter. If you can make them, do!

Check out all of the posts in our Student Loan series!

- Part 1: Student Loans: The Basics

- Part 2: Student Loan Repayment Options

- Part 3: Student Loans: Consolidation

- Part 4: Student Loans: The Effect of Extra Payments

My key question in regards to student loans – is there any avenue towards getting a lower interest rate? I’m in the situation where student loans are my highest principal balance (25k) at relatively high fixed rates (7k @3.25, 18k @ 6.8%).

Consolidating doesn’t help lower my total overall cost (as you point out), so is there any option to lower the total money I will pay, other than having to increase my cashflow per month?

The best way to lower the total amount of repayment is defintely to pay extra. Each time you do so, you are lowering the principal which helps lower the amount of interest that accrues the next month, which allows more of your payment to go towards the principal and so on. As I showed above, even $50/month, which is just $25 a paycheck if you are paid twice a month, can make a huge difference on both the total amount of interest paid and the amount of time it takes you to pay them off.

If you think that $50 is too much, try $25. Or even $10. Make dinner at home one Friday night instead of going out or ordering in, and put the cost difference towards your loan. You would be surprised how fast you will see a difference.

You could always try to get a consolidation loan from a bank if you have excellent credit since rates are so low right now. But even “high” student loan rates are usually fairly favorable compared to other types of debt.

Sometimes it really doesn’t make sense to pay off large debts early because that money can quite often be shifted in a different direction so it can work much more beneficial for a couple or an individual.

Absolutely. It is definitely a trade off. Everyone’s situation is different, and it depends on your income, expenses, savings goals, age, tax bracket and so much more, including your general attitude about debt.

I’m working on my MBA right now, and every single one of the 6 or so of the newly government-backed loans I have had issues to be have had rates of between 6.5% and 8.0%. That’s way too uncomfortably high for my taste. Only plus is that interest is tax deductible, but it’s still painful, especially compared to my 8 year old undergrad private loans, currently at 3.25%

Hi Rassah,

It’s true that gov loans for grad students are at a much less favorable rate. If you have excellent credit you might actually be able to get a personal loan, peer-to-peer loan, or even a credit card with an equal or lower rate. That said, gov loans have the best terms when it comes to deferring payments while in school and income-based repayment. But if the government really wanted to increase the rate of Americans with advanced degrees it should certainly consider lower rates on these loans!

All the more reason to work your butt off and get a couple of scholarships and avoid this whole problem.

Excellent point Jenna! If only we could get to more people while they were still young enough for it to matter

I have about $200,000 in student loan debt. I have about 77k from a private undergraduate institution at 5.5% interest rate averages. I have another 120,000 or so from graduate school at about 7.5%. Those rates are very high. Fortunately, my wife and I will have a joint income of $101,000. We have no kids. We are going to have a relatively low mortgage payment. Jill, what do you think would be my best bet for a loan payment option? I am planning on doing the extended repayment which would result in over $200,000 in interest on my principal. My plan is to make the 10 year repayment plan payment (to lower total interest), but by signing up for the 25 year repayment option if there is a month I can’t afford my payment I have the option to pay less. Do you think with my gross income of $65,000 I should consider an income based repayment plan? I just need some advice because I’m in a ton of debt.

Some mortgages have stipulations about paying the loan off early or making double payments; are there any stipulations with students as to how quickly you are allowed to pay them off? Are there any penalties? Do you know if that fifty extra dollars goes straight to paying down principle – or is still partly going to interest?