I logged into my Lending Club account this week to see how my loans are doing. So far my net annualized return on investment is 8.44%!

My Lending Club Account

My loans are all current, which is much better than the loan I had at Prosper, which was charged-off last week because the person filed bankruptcy.

Although, in all fairness, that loan was at 15.5% because the it was a credit grade D. I was pretty greedy when I first started out in peer to peer lending.

I learned my lesson, and at Lending Club I’ve carefully selected loans with a grade A. The interest rate is lower (7.68% – 9.63%) but there’s a much greater probability that they will pay! And so far they all have!

Open a Lending Club Account

If you’re interested in opening a Lending Club account, here is a Lending Club Step-By-Step Guide to get you started. Minimum investments, interest rates, and requirements are detailed in my Lending Club Review.

Net Annualized Return on Investment

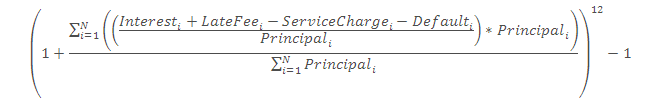

Lending Club uses the net annualized return method to show the performance only on the money you have received payments on to date, accounting for the service charge and defaulted loans. It doesn’t compare neatly to stock market returns, but it does give you a good indicator of the return you are getting on your money.

Here’s the formula for the math junkies out there:

Your Lending Club Account

How is your Lending Club account doing? Log in and check your net annualized return on investment (which should show on the first page when you log in). I’d love to hear how readers are doing!

- What is your net annualized return on investment?

- Are all your loans current?

- What investment grade loans did you select?

- Did you select the loans yourself or use the portfolio builder?

You can get my latest articles full of

valuable tips and other information delivered directly to your email for

free simply by entering your email address below. Your address will never be sold or used for spam and you can unsubscribe at any time.

I’m at 12.15%. All of my loans are current (11) and one was paid off early. I created my own portfolio and it’s structured like this:

A (36%)

B (8%)

C (28%)

D (20%)

E (8%)

The note that was paid off early was also a D. I’m still relatively early into the terms so the fact that they are all current isn’t a huge surprise, but I expect one of the 12 notes I took out will eventually default.

But when choosing where to invest the funds I paid more attention to how much they were asking to borrow and for what purpose than just the credit grade alone. I’d like to think that this helped me pick the safest of the risky loans to minimize defaults. Only time will tell, but so far, so good.

I just barely started. But my 4 notes, all A, are offering me a net annualized return of 8.83%. So, it’s probably time to branch out a little bit and do a little more. Like Jeremy, though, I look at the reason for borrowing. I like to help people who are getting loans for business needs.

@ Jeremy and Miranda: I love reading about what they want to do with the money, too. I probably spend too much time on that part.

I helped fund a kitchen renovation with one of the loans, and I often wonder how it turned out!

What made you choose Lending Club over Prosper? I have yet to make the big leap but would consider now seeing more feedback.

I just signed up for Lending Club, but have had a very good track record with Prosper over 2+ years. Granted, I only have five loans, but they range from A to D, and in over 2 years I’ve only had a late payment once.

I’d say reading the borrower’s statement was very important, since you can often sniff out the shady ones that way. One thing to watch for: repeat/serial loan listings from the same borrower with wildly different stated purposes. Also, I don’t know about Lending Club, but Prosper would let you ask the borrower questions about their finances and monthly budget. As a rule, I loaned only to those who answered and could show that they had budgeted enough to repay the loan.

My Lending Club Account is getting 10.18% net annualized return. All four loans are current, and one borrower is paying extra every month, which is nice to have a little more $$ to invest again. I know that means I don’t get to earn interest off him/her, but I’m happy to see their progress in paying it off early. Makes me think I invested in a really good person who has their stuff together. This is why P2P Lending is better than banks. I really, really care about investing in good people who have their acts together. Not just people who can do math. (i.e. I don’t want to finance your Sea-doo because you’re overfinanced on your truck).

I’m at 9.4%!

No lates so far, and my notes are pretty old (nearly halfway through the 3 year repayment process).

After 1.5 years and over 200 loans, I’m at 7.34%. This is because I had a few defaults (about 10 of my loans). But gosh! what a great return after defaults and fees. I’ am now investing again after they reopened and I’m never coming back to Prosper. Quality of borrowers is better, and there is no drama with Lending Club (no quiet periods, no out-of-control defaults, and only good credit borrowers, etc).

I’ve only been doing Lending Club for 3 months but so far I’m at 11.47%. I have about 20 loans or so. I’m hoping none of my higher rate loans default, but some probably will. Generally, if I invest in a D, E, or F I read the reason they need the money, and usually only go in on small sums less than $5k. I keep a pretty balance portfolio across all the percentages with enough A’s to balance out my higher risk investments.

I’m trying to get my portfolio to a point where I’m getting paid atleast $25/month so I can reinvest in other loans.

I just started my account at Lending Club and saw the $25 credit to my account. I’m sort of on the sidelines right now but will invest conservatively.

Can anyone tell me what exactly happens when a borrower defaults at Lending Club? What if they file Bankruptcy?

Thanks!

Brian, They have a collection agency try and collect once the delinquency goes to long. Also, once someone files bankruptcy the debt is discharged. Your out of luck.

My loans at Lending Club are currently earning a Net Annualized Return on Investment of 8.75%. I haven’t had any late or missed payments since I made the loans about a year ago. This is a small sample size though, as I only have a few loans (residents of my state are not currently able to fund new loans via LC).

I’ve only dabbled in social lending. To spread my risk out a bit, I balanced investments in Lending Club borrowers between a medium-risk borrower with a low-risk borrower. Both loans are being paid and are in good standing, yielding an approximate net annualized return on investment of roughly 11%. Not bad for a rookie.

I’m currently at 12.58% – no defaults yet (knock on wood), and one borrower paid off their entire loan after two months (he had said in the description that he hoped to pay it off much sooner than three years, so that was vaguely expected, just not quite so soon).

My spread is:

1. A (25%)

2. B (5%)

3. C (20%)

4. D (35%)

1. E (10%)

2. F (5%)

3. G (0%)

I value A’s as “low risk” and try to keep them at 1/4 of my loans. The rest I try to bell curve (totally ignoring G’s).

When looking to invest, I sort loans by amount left to fund. This lets me minimize the amount of time I’m in the “funding” stage (thus getting me into the interest garnering phase sooner) and also tends to show me loans other people think will pay off. I still read the reasons for the loans and if something sounds fishy or I just plain don’t like the loan for whatever reason, I don’t go for it.

I decided to invest some money “risky” to see what the worst case scenario would do.

For this risky portfolio, I am getting a return of 16.05% on mostly C & D loans, a few E loans & 1 F. I chose debt consolidation, no or VERY well explained delinquencies, Lending club approved and income verified, credit score 679 or higher.

For my “regular” portfolio, I am getting 13%. It’s mostly C and B, all debt consolidation, no delinquencies, <$20,000, good income, Lending club approved and income verified, and (usually) credit score 719 or higher.

For both, I read the statements & Q & A VERY carefully to see if the borrower gets the fact that people are lending their own money, and also to see how well they understand their own situation (that they still have work ahead of them).

No delinquencies in my lower risk portfolio. For my risky one, 1 was 2 weeks late once, but has been since since. Another is pretty new, and has only made 2/5 payments — i expect it will default.

Interestingly, both late loans were to people who worked in the financial market and seem to be relatively young (perhaps 30s).

I have used Prosper and Lending Club for a few years and several thousand loans. In both cases I set up a profile for loan selection. I have nearly finished liquidating my Prosper account and the nominal 12% return became a 3% loss. Lending Club does a better job of screening the loans but defaults are still excessive IMO. They need to do a better job of due diligence before listing. Income still does not pay an adequate role in the screening process. At this point I still invest a few hundred dollars each week. My nominal 12% yield becomes 7.95% at this point after defaults. The program would work better if loans with an expected default rate of 3% or higher were declined. They also should not accept loans with income of less that $3,000 per month. If income is that low then a second income or guarantor should be required.